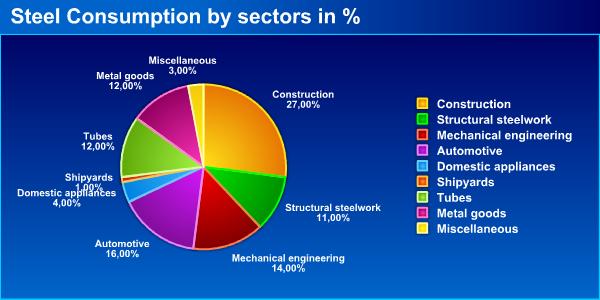

Looking at the data above, the European steel consumption by sectors can be seen. It can be detailed in order to look closer to the performance of the end users in the flat steel consumption such as white goods, automotive, tubes, shipyards, mechanical engineering and metal goods.

The main flat steel consumer sectors are as follows;

1) Automotive2) Construction

3) Metal goods

4) Tubes

5) Mechanical engineering

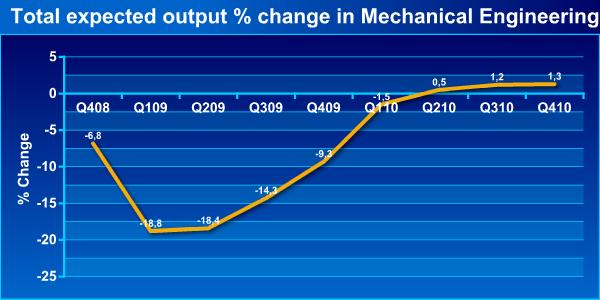

Mechanical engineering:

Fourteen percent of European steel consumption belongs to mechanical engineering. This sector has also been considered as one of the most negatively influenced sector from the global financial crisis. In these days, when the production has been reduced by 40-50 percent, the investments have been tightened and there have been some credit issues, production figures have still been decreasing since late 2008. Demand has been tightening both in the European local and export markets. According to the data announced by VDMA (German Engineering Federation), February 2009 orders of the German machinery producers have decreased by 50 percent compared to the same month of 2008. On the other hand, according to the table above, no positive figures will be seen until the first quarter of 2010.

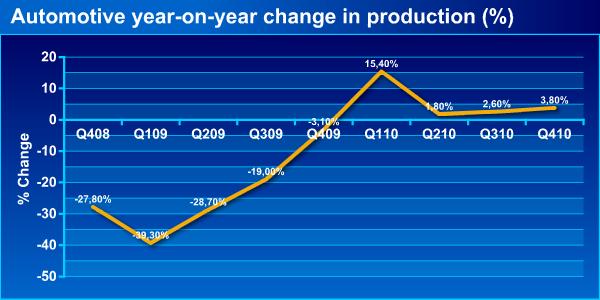

As the main sector in Europe, automotive has the sixteen percent of the overall steel consumption in Europe. While the 2009 figures are not clear yet, indications are a bit negative for the time being. According to the European Automobile Manufacturers Association (ACEA), auto sales have decreased by 17.2 percent to 3,439,720 in the first quarter of 2009. On the other hand, the decrease in Europe has been softened thanks to the sales uptrend in Germany in the same time period. However, auto sales have decreased in other European countries, such as 30.5 percent in the UK and 38.7 percent in Spain. On the other hand, production in automotive is being projected to decrease at a slow rate until the first quarter of 2010.

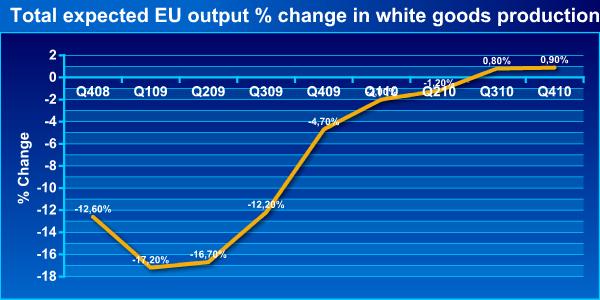

White goods has the four percent of the overall European steel consumption. White goods has also been deeply effected by the global financial crisis as the housing sales have decreased and there have been credit issues. Also, competition from Asian steelmakers has been creating pressure on stocks. Central Europe origin steel demand had influenced the overall European demand in a positive way; however, this region has been struggling with its own financial problems recently. On the other hand, production in white goods is not being expected to register positive trend until the third quarter of 2010 as it can be seen at the picture above.

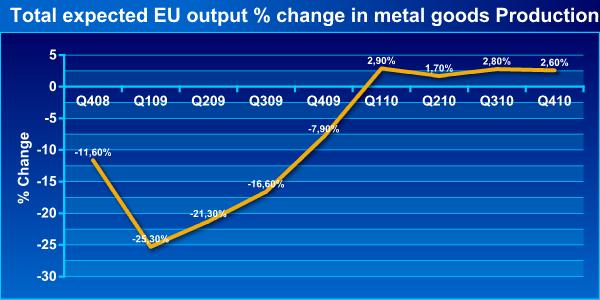

Metal goods:

Metal goods has the twelve percent of the overall European steel consumption. On the other hand, production in metal goods is not being expected to register positive trend until the third quarter of 2010 as it can be seen at the picture above.

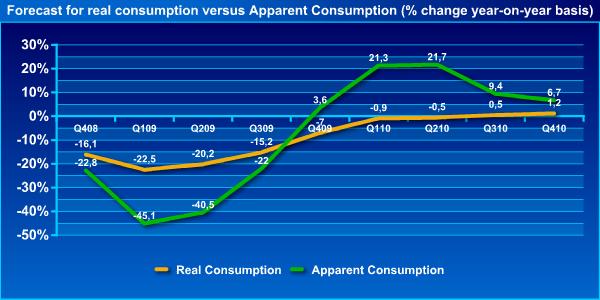

Apparent consumption vs. real consumption:

Since the last quarter of 2008, apparent steel consumption in Europe has decreased by 22.8 percent, while the real consumption has decreased by 16.1 percent. It is estimated that the demand downtrend has reached the bottom point in the first quarter of 2009 as the apparent consumption has decreased by 45.1 percent; real consumption has decreased by 22.5. It is thought that the dectocking period will be over as of the last quarter of 2009 and apparent consumption will register recovery in the first two quarters of 2010 as a respond to the decreasing stocks. However, it is also expected that the real consumption will not meet this trend and the apparent consumption will get closer to the real consumption in the third and the fourth quarters of 2010. According to these estimations, in 2009 and 2010, it seems really hard to reach the peak levels of 2008. However, if there will be a recovery in the financial markets and real sector, it should be noted that this estimation may not occur. To understand and see this trend, balance sheets of banks should be monitored closely.

Source for all data in the pictures is EUROFER. Data is composed by SteelOrbis and year on year basis. (Data is composed by SteelOrbis on y-o-y basis)