Decarbonization efforts are now being ramped up across the globe and, as countries begin to implement new export restrictions to meet their net-zero goals, ferrous scrap is rapidly becoming a highly sought-after commodity.

On the one hand, global ferrous scrap consumption in steel production is set to rise as efforts to reduce the industry's environmental footprint are ramped up, alongside an expected increase in the share of electric arc furnace (EAFs) in the global steelmaking process.

On the other hand, scrap quality is a limiting factor in terms of increased scrap use. Certain types of scrap contain relatively high quantities of trace elements, whereas high-quality steel requires a low trace element content. Scrap is used for lower quality steel grades, such as long products: rebars, wire rods and reinforcement bars. However, EAF-based steel producers are gradually moving toward the production of higher quality products. In the longer run, declining steel scrap quality and increasing steel quality may pose serious challenges for recycling.

The lower the scrap quality, the lower the yield, and thus the higher the energy requirement per ton of desired output. A significant increase in the consumption of scrap with replacement of usage of iron ore and pig iron is possible only under conditions of access to cheap electricity or significant financial subsidies from governments. In the absence of access to cheap electricity and subsidies, the production of steel by EAFs from scrap may become significantly more expensive than production of steel by BOFs. And it will be extremely difficult for these products to compete in the markets.

Considering the above, demand will increase for high quality scrap with minimal harmful impurities. In theory, scrap can be melted into steel an infinite number of times, but in practice, with each such remelting, the share of harmful impurities in scrap increases, which then results in reduced quality of finished products.

Despite the importance of scrap as a raw material, the global ferrous scrap market faced negative trends in 2023. Global ferrous scrap consumption fell by five percent to 0.59 billion mt in 2023, compared to 0.62 billion mt in 2022. The decrease in consumption and importation of scrap is directly related to the decrease in crude steel outputs of major scrap importing countries. Steel production in 2023 fell in the EU by 7.3 percent, in North America by 6.3 percent, and in Turkey by 4.5 percent, according to SteelOrbis’ data. The steel market has been negatively affected by high lending rates, which slows down business activity, by inflation and currency depreciation in different regions of the world, as well as by high energy prices.

In 2023, one of the biggest scrap importers, Turkey, failed to recover from its decline in 2022. Turkey’s steel industry has been struggling with lower competitiveness in the global markets, as the efficiency of the country’s production model had been under pressure from increased energy costs and financial problems during recent years. Turkish steel producers have had difficulties in sustaining active exports, while struggling with limited local business activity and high costs.

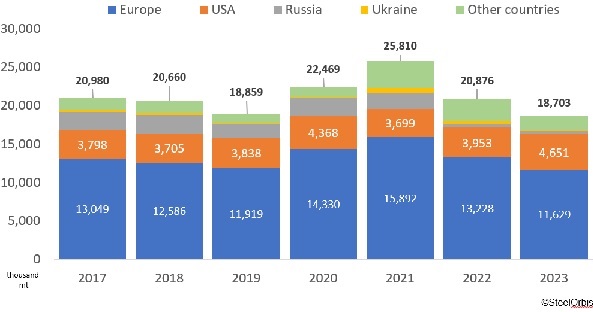

Turkey is one of the world leaders in the consumption (27.9 million mt in 2023) and import of scrap, which is due to the high share of EAF steelmaking capacity in the local steel industry (more than 73 percent in 2023), according to SteelOrbis’ data. Turkey in particular consumes the lion’s share of European exports of steel scrap. In 2022, the EU exported 17.6 million mt of scrap, including 13.2 million mt to Turkey. In 2023, the corresponding figures were 18.1 million mt and 11.6 million mt, respectively, according to SteelOrbis’ data.

In 2023, Turkey’s scrap imports fell by 10.4 percent year to year to 18.7 million mt, while in 2022 its scrap imports fell by 16.5 percent year to year to 20.9 million mt. The decline in imports was due to the fall in domestic and European demand for Turkish steel products, the unrealized expectations for active demand for steel after the earthquakes in February 2023, rising inflation and the depreciation of the Turkish lira.

Turkey’s scrap imports continue to drop in 2023

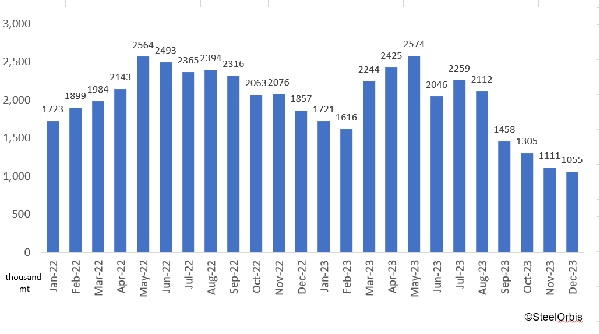

Weak finished steel demand in Turkey was the main reason for lower scrap purchases by Turkish mills in 2023. The monthly average of scrap stocks in Turkey in 2023 fell by 15 percent to 1.8 million mt, as compared to 2022. Even the rise in imports in the fourth quarter did not allow Turkish steel mills to increase their levels of scrap stocks. In December, scrap stocks in Turkey were down 39 percent to 1.06 million mt as compared to the beginning of the year, falling to the lowest level in the last six years, according to SteelOrbis’ data.

Turkey’s steel scrap stocks decline by 40 percent in 2023

In many countries, ferrous scrap is already defined as a strategic raw material rather than as a waste product. Most countries will focus on domestic consumption rather than exports, which will increase domestic and regional scrap trade and measures to encourage scrap imports by the largest consumers. In contrast, the largest exporters will increasingly restrict scrap exports.

Using scrap for steelmaking in electric arc furnaces is the easiest way to reduce CO2 emissions in the steel industry by utilizing existing production technologies. However, the problem is that globally not enough scrap is collected to switch fully to electric arc furnace steelmaking. Therefore, countries are already beginning to compete for access to scrap and this competition will increase in the future.

To deliver low-carbon emissions steel, steel mills globally have been acquiring scrap recyclers as part of a strategy to secure access to the raw material as demand continues to rise amid the decarbonisation drive. Vertical integration in the steel industry is set to continue as steel mills seek to secure access to steel scrap required for low-carbon emissions steelmaking, which in turn will drive mergers and acquisitions moving forward. Steelmakers around the world are now making plans or are already implementing projects to increase EAF utilization, so global scrap consumption will increase. However, of major concern will be the issue of the availability of high quality scrap with minimal harmful impurities, the volumes of which are currently limited in the market.