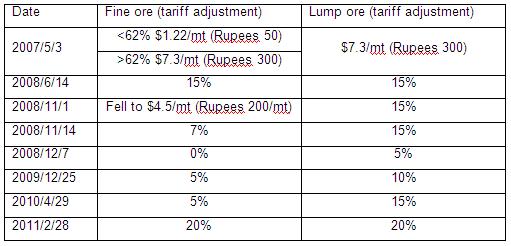

The India government has announced that as of February 28 the export tariffs on Indian fine ore and lump ore will both rise to 20 percent, while the export tariffs on iron ore pellets have been cancelled. The previous export tariffs on Indian fine ore and lump ore were five percent and 15 percent respectively.

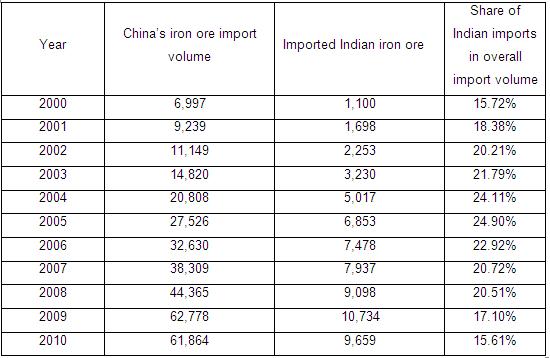

After the adjustment, if we calculate the price on the basis of the current Indian ore (Fe 63.5 percent) price of $170/mt FOB, the export costs of fine ore will increase by $22-25/mt. Thus, Indian iron ore traders' profits will be hit strongly, and they may even incur losses. According to previous experience when India adjusted its export tariffs, the increased export costs will be passed on to Chinese traders by Indian miners and traders, and this would be expected to provide support for the currently weak Chinese iron ore market. Since India started to restrict its iron ore exports from 2007, its iron ore export tariffs have been adjusted constantly, while at the same time the share of iron ore imported by China from India has continued to decline.

Share of Indian iron ore in China's total iron ore import volume from 2000:

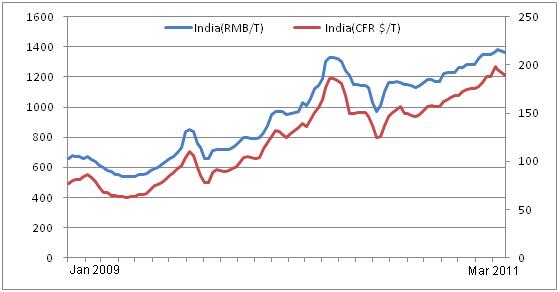

After the Spring Festival, the price of imported Indian ore for China started to decline gradually. In line with the recent weakness of the construction material market in China, the prices of imported iron ore have begun to fall, with the price of Indian fine ore (Fe 63.5 percent) falling to $188/dry metric ton CFR in late February from $198/dry tons CFR in mid-February. At present, purchase volumes from steel mills in China are on the low side.

Spot prices and CFR iron ore prices from India to China since 2009:

Indian iron ore export tariffs adjustment from May 2007 to February 2011: