China grabbed a bigger share in the global steel market in 2023 amid the slowdown seen in its domestic demand, especially from the construction industry, while its production remained at strong levels. SteelOrbis has surveyed major Chinese trading companies and steel mills regarding their expectations for 2024.

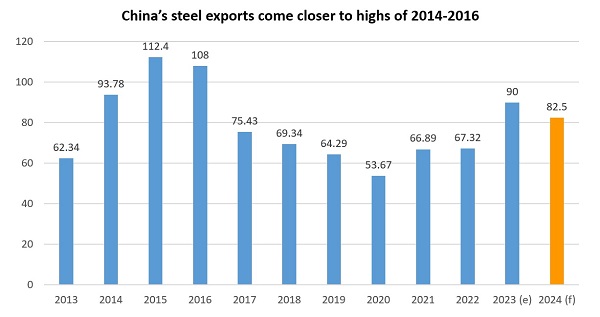

China sees strongest year for steel exports in 2023 since 2016

In 2023, total finished steel exports from China are expected to reach 90 million mt, up almost 34 percent from 2022 and constituting the highest volume since 2016. The increase in steel exports was mainly due to the rise in exports of HRC, which were up 73 percent year on year in the first 11 months of 2023, according to sources. The strong steel export volumes were due to the slack demand from the domestic market, which caused steel products to flow towards the export markets. At the same time, infrastructure construction in countries in Southeast Asia and in the One Belt One Road area was also considered to be a factor contributing to the rise in exports of China’s steel products.

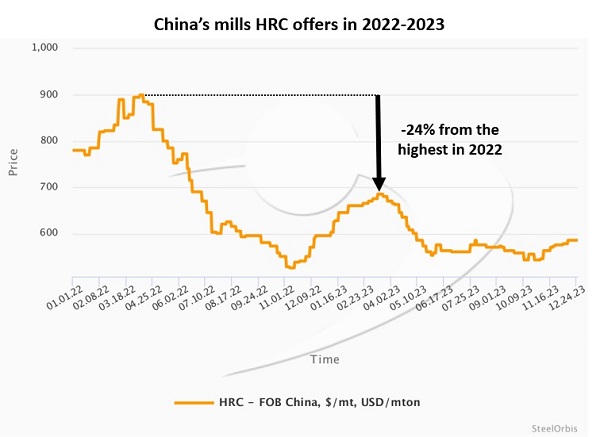

In addition, declining export prices were a major factor stimulating HRC exports. In 2023, Chinese mills’ average HRC price was $596/mt FOB, according to SteelOrbis’ data, down by 15 percent or $102/mt year on year. “Generally, in a year of slack domestic demand, steel exports would increase, which was the situation in 2014-15. In 2023, demand for steel in the domestic market was slack, while the deprecation of the Chinese currency was another factor bolstering steel exports,” a major Chinese player said.

While in the last weeks of the year, the Chinese market was showing rebounds, with rises in HRC futures prices supported by possible steel production restrictions and rumors of banking interest rate cuts, physical HRC sales, both in the local and export markets, were still rather slow due to the very cold weather in China. At the same time, most market insiders are more positive than negative on the prospects for 2024 or at least for the start of the year, expecting China to remain active in exports of HRC and flats in general, with Chinese non-VAT traders expected to dominate the market.

“China’s non-VAT trading gained momentum in 2023, leveraging its low-cost advantage and seizing a share in the international market. Given the relatively challenging conditions, non-VAT trading is expected to continue next year,” the representative of one steel producer said, adding, “China's economy is bad now and state-owned banks are also affected by this, and so the government may not find an appropriate way to control the situation.”

Forecast for 2024

In 2024, domestic steel demand in China is expected to remain stable in key segments next year or post just a tiny increase overall. China’s real estate industry may indicate an improvement amid the stimulus policies issued by the central government, including the rebuilding of villages in megacities, the continuing guarantee for delivery of properties in China, and the loosening of purchase restrictions for housing purchases, which will contribute to better demand in the domestic steel market, which may result in lower steel exports compared to 2023.

However, not all market players are very optimistic for Chinese domestic demand. “In my humble opinion, China’s domestic demand is still at low levels because the trend in the real estate industry has not changed and, if demand increases, it will be from other sectors, like infrastructure or vehicle production, and so the steel producers will maintain their focus on the overseas markets,” a representative of one mill said.

As for the price trend, most Chinese suppliers believe the upward trend seen in December 2023 may continue in the first quarter of 2024 given the expected production cuts in China, though the global recession and the lack of sufficient production cuts may affect the sector and cause prices to settle at lower levels again from the middle of 2024. “We actually do not expect that China’s steel exports will reach 90 million mt next year, as forecast for this year. If we want to be realistic, some slowdown is anticipated in export activity from China in 2024, but it should not be more than a 5-10 million mt drop, while HRC exports should be maintained,” the representative of a Chinese mill told SteelOrbis.

Market predictions widely anticipate that the US Federal Reserve will cut interest rates in mid-2024 or earlier, stimulating the growth of steel demand in emerging economies as liquidity in the US currency recovers, according to market sources.

As for steel production expectations for 2024, the Chinese government has not published any policy for production restrictions and so steel companies will maximize capacity utilization rates only reducing outputs when there are temporary orders from local governments aimed at improving air quality.