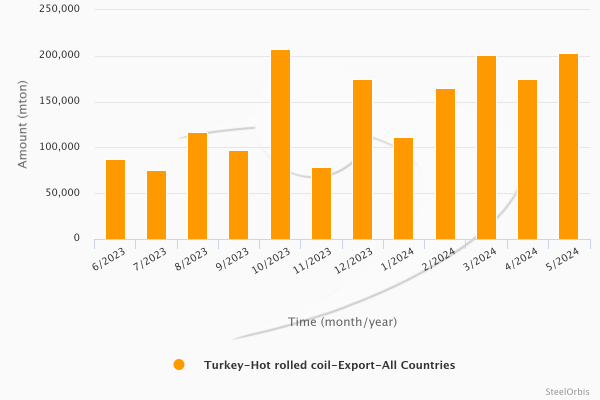

In May this year, Turkey’s hot rolled coil (HRC) exports amounted to 202,666 metric tons, up by 16.1 percent compared to April and up by 136.8 percent year on year, according to the preliminary data provided by the Turkish Statistical Institute (TUIK). Meanwhile, the revenue generated by these exports totaled $131.99 million, increasing by 8.8 percent compared to the previous month and increasing by 108.8 percent year on year.

In the January-May period, Turkey's HRC exports amounted to 854,445 mt, up 107.7 percent, while the value of these exports increased by 90.6 percent to $577.13 million, both year on year.

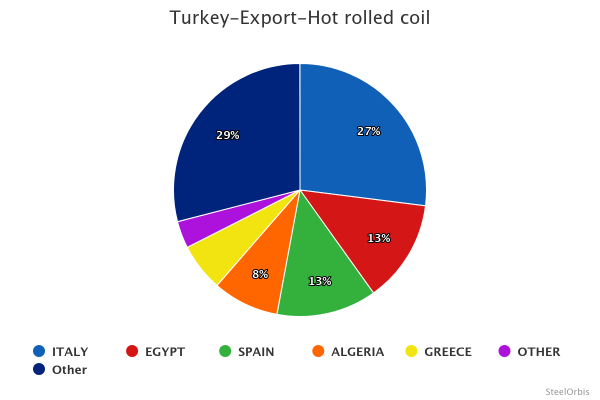

In the given period, Turkey’s largest HRC export destination was Italy with 230,693 mt. Italy was followed by Egypt with 112,227 mt and Spain with 109,366 mt.

Turkey’s top 10 HRC export destinations in the January-May period this year:

|

Country |

Amount (mt) |

|

|

|

|

|

|

|

January-May 2023 |

January-May 2024 |

Y-o-y change (%) |

May 2023 |

May 2024 |

Y-o-y change (%) |

|

Italy |

124,915 |

230,693 |

84.7 |

31,283 |

97,595 |

212.0 |

|

Egypt |

78,093 |

112,227 |

43.7 |

22,476 |

30,946 |

37.7 |

|

Spain |

27,317 |

109,366 |

300.4 |

- |

10,195 |

- |

|

Algeria |

11,106 |

72,324 |

551.2 |

7,907 |

10,031 |

26.9 |

|

Greece |

28,570 |

52,261 |

82.9 |

1,184 |

16,771 |

>1000.0 |

|

Morocco |

9,979 |

25,626 |

156.8 |

- |

16,334 |

- |

|

United Kingdom |

12 |

25,301 |

>1000.0 |

- |

- |

- |

|

Macedonia |

24,432 |

21,577 |

-11.7 |

5,041 |

2,072 |

-58.9 |

|

Portugal |

- |

20,285 |

- |

- |

- |

- |

|

US |

- |

18,748 |

- |

- |

- |

- |

Turkey’s main HRC export destinations on country basis in the January-May period this year are presented below: