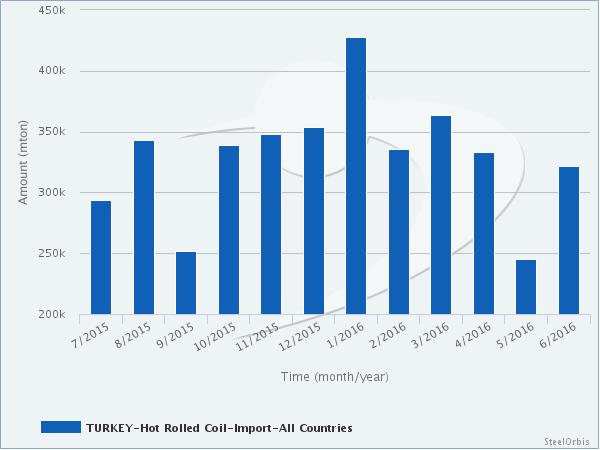

In June this year, Turkey's total hot rolled coil (HRC) imports increased by 21 percent year on year to 321,306 metric tons, according to the data provided by the Turkish Statistical Institute (TUIK). These imports had a value of $130.1 million, increasing by 16 percent year on year.

In the half of the current year, Turkey's HRC imports amounted to 2.03 million mt, rising by 22 percent, while the value from these imports decreased by 17.6 percent to $658.6 million, both compared to the same period of the previous year.

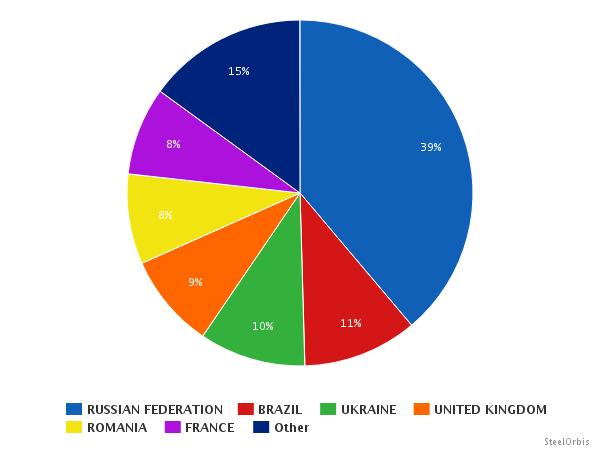

In the January-June period of this year, Russia ranked first among Turkey's HRC import sources, with its HRC exports to Turkey amounting to 787,238 mt, up 26.5 percent compared to the corresponding period of the previous year, followed by Brazil which shipped 217,227 mt of HRC to Turkey in the given period.

Turkey's top HRC import sources in the January-June period this year are as follows:

Country | Amount (mt) | |||||

Jan-Jun 2016 | Jan-Jun 2015 | Y-o-y change (%) | June 2016 | June 2015 | Y-o-y change (%) | |

Russia | 787,328 | 622,437 | 26.49 | 132,234 | 129,752 | 1.91 |

Brazil | 217,227 | 69,526 | 212.44 | 51,911 | 4,747 | 993.55 |

Ukraine | 201,489 | 196,233 | 2.68 | 26,345 | 31,774 | -17.09 |

UK | 179,432 | 9,448 | - | - | - | - |

Romania | 170,676 | 154,906 | 10.18 | 24,674 | 15,808 | 56.09 |

France | 167,292 | 199,427 | -16.11 | 22,914 | 38,466 | -40.43 |

Netherlands | 95,447 | 55,532 | 71.88 | 2,651 | 925 | 186.59 |

Turkey's main HRC import sources in the January-June period this year are as follows: