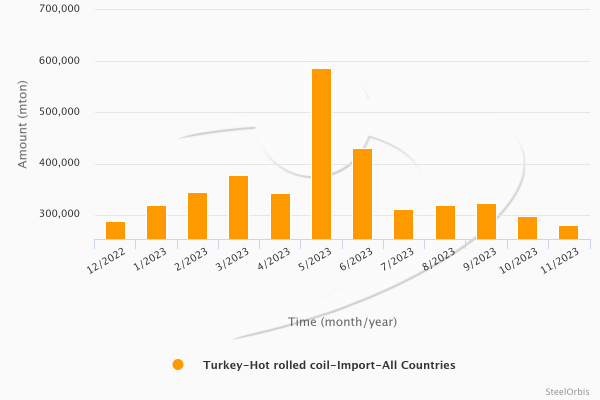

In November last year, Turkey’s hot rolled coil (HRC) imports amounted to 281,105 metric tons, down by 5.7 percent compared to October and up by 73.5 percent year on year, according to the preliminary data provided by the Turkish Statistical Institute (TUIK). Meanwhile, the value of these imports totaled $182.25 million, declining by 6.3 percent compared to October and rising by 63.9 percent year on year.

Meanwhile, in the January-November period last year, Turkey’s HRC imports amounted to 3.93 million mt, up by 8.8 percent compared to the same period of the previous year, while the value of these imports totaled $2.67 billion, decreasing by 14.2 percent year on year.

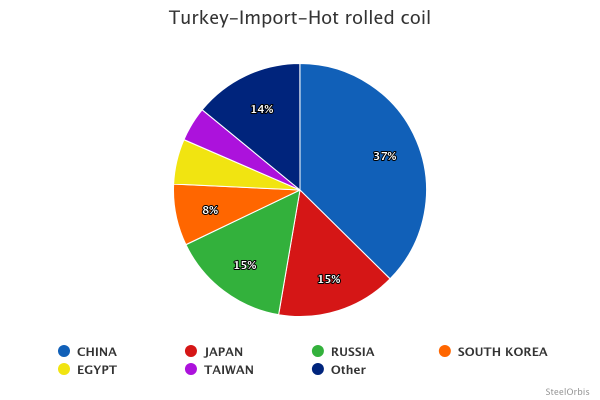

In the given period, Turkey’s largest hot rolled coil import source was China which shipped 1,470,732 mt to Turkey, up 184.2 percent year on year. China was followed by Japan with 601,841 mt, up 134.1 percent, and Russia with 597,228 mt, down 45.7 percent, both on year-on-year basis.

Turkey’s top HRC import sources in the first 11 months of last year are as follows:

|

Country |

Amount (mt) |

|

|

|

|

|

|

|

January-November 2023 |

January-November 2022 |

Change (%) |

November 2023 |

November 2022 |

Change (%) |

|

China |

1,470,732 |

517,485 |

+184.2 |

142,236 |

- |

- |

|

Japan |

601,841 |

257,104 |

+134.1 |

29,471 |

8,222 |

+258.4 |

|

Russia |

597,288 |

1,099,517 |

-45.7 |

15,144 |

62,812 |

-75.9 |

|

South Korea |

309,016 |

58,764 |

+425.9 |

48,161 |

5,416 |

+789.2 |

|

Egypt |

226,885 |

- |

- |

- |

- |

- |

|

Taiwan |

173,911 |

- |

- |

- |

- |

- |

|

France |

125,481 |

270,598 |

-53.6 |

16,204 |

30,150 |

-46.3 |

|

Indonesia |

98,276 |

11,196 |

+777.8 |

- |

- |

- |

|

UK |

55,332 |

130,977 |

-57.8 |

3,014 |

524 |

+475.2 |

|

India |

53,381 |

569,224 |

-90.6 |

- |

31,346 |

- |

Turkey’s main HRC import sources in the January-November period last year are as follows: