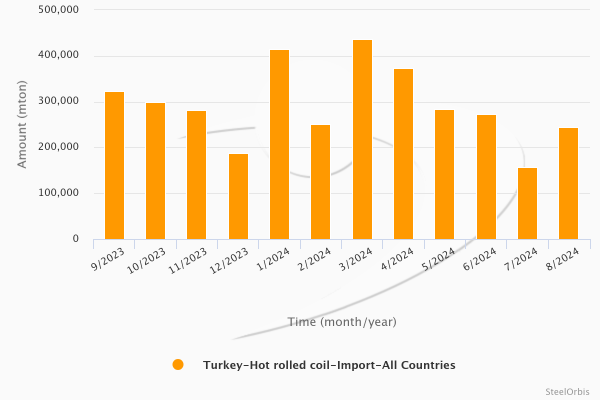

In August this year, Turkey’s hot rolled coil (HRC) imports amounted to 244,843 metric tons, up by 56.7 percent compared to July and down by 23.1 percent year on year, according to the preliminary data provided by the Turkish Statistical Institute (TUIK). Meanwhile, the value of these imports totaled $153.93 million, increasing by 33.3 percent compared to the previous month and down by 28.6 percent year on year.

In the January-August period, Turkey's HRC imports amounted to 2,436,519 mt, down 19.6 percent, while the value of these imports fell by 23.7 percent to $1.59 billion, both year on year.

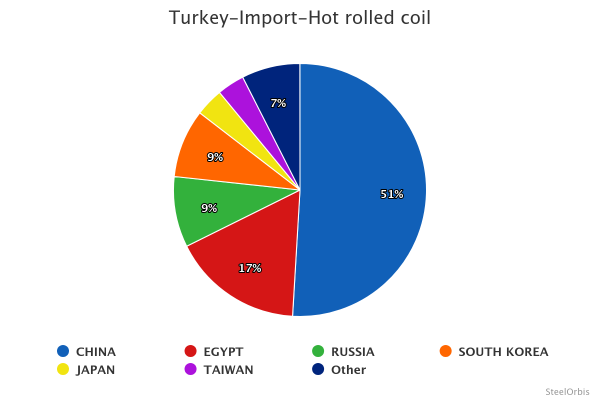

In the given period, Turkey’s largest HRC import source was China, which supplied 1,241,302 mt. China was followed by Egypt with 407,501 mt and Russia with 220,373 mt.

Turkey’s top 10 HRC import sources in the January-August period this year:

|

Country |

Amount (mt) |

|

|

|

|

|

|

|

January-August 2023 |

January-August 2024 |

Y-o-y change (%) |

August 2023 |

August 2024 |

Y-o-y change (%) |

|

China |

1,153,212 |

1,241,302 |

7.6 |

90,846 |

285,057 |

213.8 |

|

Egypt |

183,663 |

407,501 |

121.9 |

49,348 |

8,865 |

-82.0 |

|

Russia |

530,527 |

220,373 |

-58.5 |

51,400 |

13,310 |

-74.1 |

|

South Korea |

178,276 |

212,834 |

19.4 |

24,871 |

24,817 |

-0.2 |

|

Japan |

392,818 |

87,037 |

-77.8 |

73,118 |

- |

- |

|

Taiwan |

164,834 |

85,362 |

-48.2 |

9,685 |

- |

- |

|

France |

85,399 |

82,998 |

-2.8 |

11,333 |

9,465 |

-16.5 |

|

Belgium |

26,480 |

30,695 |

15.9 |

3,591 |

2,912 |

-18.9 |

|

Brazil |

- |

18,727 |

- |

- |

- |

- |

|

Vietnam |

49,994 |

17,698 |

-64.6 |

- |

- |

- |

Turkey’s main HRC import sources on country basis in the January-August period this year are presented below: