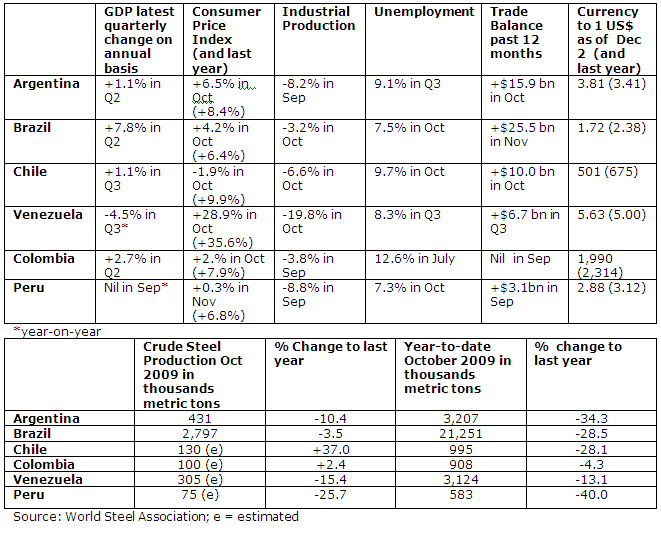

Brazil: The economic rebound remains nothing short of impressive. According to statements by the Finance Ministry the anticipated growth rate for Q3 will be between 8 - 10 percent and Q4 could see another strong 9%. With a bit of hyperbole, President Lula said his country is on a "Chinese pace" of economic growth. October saw another record month of job creation. The benchmark interest rate of 8.75 remains at a record low though it is high by the standards of almost anywhere else.

Chile: The economy grew 1.1% on a seasonally adjusted basis in Q3 from Q2, finally ending Chile's recession. It was the first quarterly growth since Q2 2008. Resurgent prices for copper helped the trade balance and economic growth. As of December 4 copper was traded at $7,150 per ton on the London Metal Exchange. Central bank officials have indicated that they will leave the record low benchmark interest rate of 0.5% unchanged for the time being.

Venezuela: The economy contracted in Q3 for the second quarter in a row, putting the country officially into a recession. Central Bank officials blamed the falling oil prices and a production cap on oil production in line with quotas set by the Organization of Petroleum Exporting Countries (OPEC). President Chavez' bragging statements earlier this year that Venezuela is immune to the global crisis are long forgotten. Disorderly management of once plentiful revenues and currency exchange controls have hurt the Venezuelan economy immensely.

Special Focus

Panama: Ten years ago this month Panama took possession of the canal that transverses its territory under a treaty signed in 1977 by then-US President Jimmy Carter. There was widespread opposition to this agreement in the US coupled with a dose of skepticism concerning the future viability of the canal. However, all indications point to a resounding success of the indigenization. The Panama Canal Authority (ACP) undertook necessary repairs and expansions, raised tolls and cut down the average transit time through the canal to less than 24 hours (27-28 hours during the US administration). The canal's share of traffic between East Asia and the US East Coast has increased from11% in 1995 to 40% in 2008. The amount of containers passing through Panama rose from 200,000 to 4.6 million during the same period. At the Atlantic end of the canal the Colon Free Trade Zone is located where $ 9.1 billion worth of merchandise was unloaded in 2008 - second only to Hongkong FTZ. Yet, merchant vessels and oil tankers are getting ever bigger. Last year the ACP announced a $5.25 billion project to build new locks which will be 60% wider and 40% longer. The ACP expects that thanks to the expansion total tonnage will rise from 280 million tons in 2005 (its base year) to 510 million in 2025. It will also further boost Panama's GDP expansion. One million out of its 3.4 million people are still living in poverty despite impressive double digit GDP growth rates in the last two years. The ACP has annual revenues of about $ 2 billion and costs of $600 million. Spare cash goes to the Panamanian treasury. In the last fiscal year the treasury received $ 760 million. But there is a caveat: Panama only ranks 84th cleanest country in Transparency's International corruption index.