To an increasing degree, the parallels between the Chinese steel industry and its beleaguered property sector are inextricably connected and eerily similar. Whilst the property sector has long been seen as “inflated” in its scale of activity beyond the long-term sustainable fundamentals of supply/demand, the same is therefore true of the steel sector. After all, demand from construction-related activity in China, with the private property sector a massive portion of it, is estimated to have accounted for upwards of 35% of total steel demand at its peak a few years ago, or roughly 330-350 million mt. With the reckoning of the property sector in full effect, the same is by definition true of steel – it has become virtually impossible to sustain steel demand on a y/y basis absent continued stimulus in support of some combination of infrastructure, manufacturing or other economic segments on a significant scale. Carried out over a number of years, such a strategy ultimately leads to a reckoning for those sectors much the same as property, ultimately leaving steel demand subject to massive downside pressure in the long run.

All of that said, the preponderance of evidence with respect to China’s stance on the key economic sectors that determine steel demand in 2024 points to yet another year of likely stability at worst, and potential minor upside at best.

As WSD sees it, the components of Chinese steel demand for 2024 add up to a “slight decline” of about 15-20 million mt on a year-to-year basis based on existing trends and absent additional stimulus measures, as follows: a) property at a negative 15-20 million mt; plus, b) infrastructure at a positive 20 million mt; plus, c) automotive at a positive 3-5 million mt, or about 8% y/y; plus, d) manufacturing at a negative 10-15 million mt. Hence, any incremental measures in support of property-related activity would, at a minimum, ensure that Chinese steel demand remains flat year over year in 2024 and perhaps registers a moderate increase on the order of 5-15 million mt versus 2023 levels. The latter scenario would almost certainly allow for a decline in Chinese steel exports, perhaps by as much as 10 million mt compared to 2023 – a figure that could prove to be the difference between a “Bad Times” and “Fair to Good Times” environment for the global steel industry.

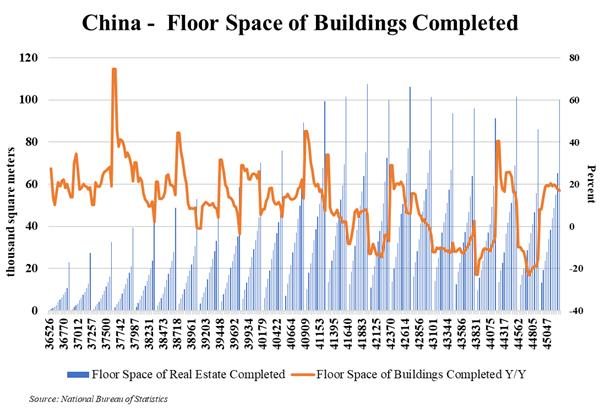

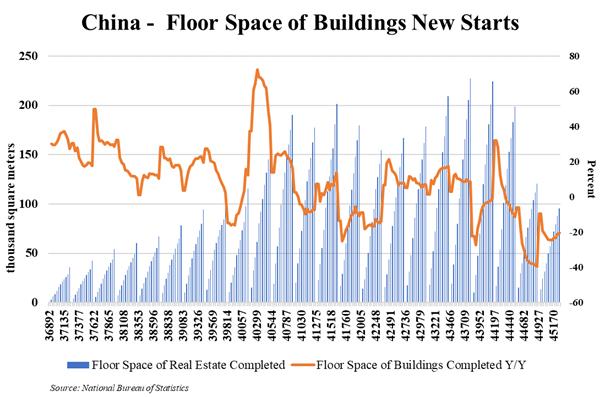

Whilst little has been made of the “Three Major Projects” program announced in early-November of last year – largely due to the lack of definition around its scope and financing – there is increasing evidence that at least some form of implementation is kicking into gear with roughly 1 trillion RMB of funding reportedly allocated to the programs, albeit the duration, scale of annualized spending, and other key details remain unclear. As previously mentioned, recent speculation has surfaced about a government document outlining a potential affordable housing program amounting to 6-10 million housing units over the next five years, although some of these could involve conversions of existing excess housing supply or completions of already-started projects. Nevertheless, some speculative estimates suggest that such a program could result in 80-100+ million square meters of incremental housing construction per annum – a figure that amounts to about ~10% of the 840 million SQM reportedly under construction as of December 2023. (Note: The “Three Major Projects” is an initiative to increase construction of social and government subsidized housing; renovation of so-called “urban villages” – underdeveloped areas in located within major urban areas; and improved infrastructure in support of provisions for natural disasters.)

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2024 by World Steel Dynamics Inc. all rights reserve