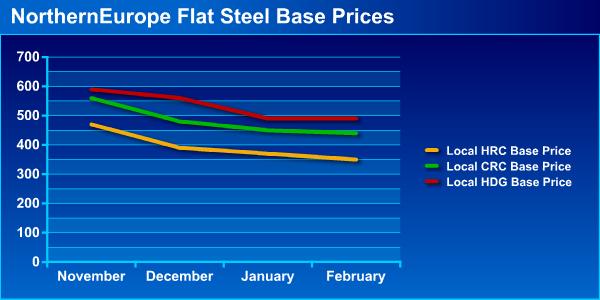

In the local markets in northern Europe, HRC base prices are currently in the price range of €340-400/mt, CRC base prices are at €440-470/mt, while HDG base prices are at €480-510/mt. All these prices are ex-works.

Ex-CIS HRC offers to northern Europe are currently at €330-340/mt CFR, whereas the effective ex-India HDG selling price levels, including all extras, are in the range of €470-480/mt CFR northern Europe.

It is observed that the number of import deals is decreasing significantly at the moment; however, there are concerns that Chinese origin HRC and CRC offers may create pressure on the European flats market in the mid-term, just as happened in early 2008.

In order to understand the market trend in northern Europe, the nature of the deals should be considered more than the actual offer levels. Thus, looking at the very few export and import flats deals in Europe, it can be seen that the deals in question are not driven by demand. Two factors appear to provide the spark for deals at the present time. First, buyers think that the current price levels constitute the bottom point and they seek to cut their average costs by buying at bottom levels, especially since their current stocks are generally expensive. On the other hand, concerned that prices may decline further, some other significant market players have been buying material only to meet their minimum needs.

Additionally, in northern Europe, based on end-user' expectations that iron ore and coking coal annual contract negotiations will result in low prices, no price recovery is expected in 2009.

Another factor that should be considered is that offers from non-EU countries may bring pressure to bear on the the flats prices of European producers in their local markets.

According to World Steel Association data, world steel production decreased by 24 percent year on year in January, while steel consumption in the EU-27 countries retreated by 45.9 percent in January 2009 compared to the same month in 2008.

Meanwhile, according to the Economic and Steel Market Outlook 2009-2010 report from EUROFER, the destocking process may come to an end towards the third quarter, based on the relationship observed between real and apparent consumption in this report. In other words, it is thought that although producers in northern Europe have been working at 50 or 60 percent capacity, the greater part of 2009 will be required to melt the high, and also expensive, stock levels. However, positive figures may be seen in 2010 as stocks will have declined by then. Nevertheless, the recovery of real consumption in 2010 is likely to be relatively slow.

According to the EUROFER report, considering all steel consuming sectors in Europe, a reduction in consumption of 11.3 percent is expected for the first quarter, a fall of 9.3 percent is expected for the second quarter and a 7.4 percent reduction for the whole of 2009. The sharp downtrends seen in the automotive and pipe sectors so far in 2009 provide an indication of the hard times facing the overall European flats market during the rest of 2009.