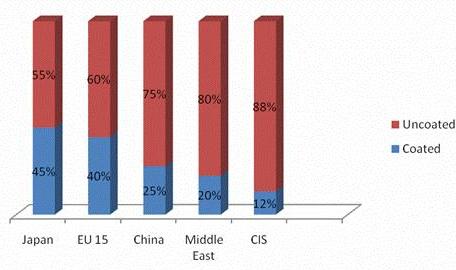

It is well known that the usage rate of coated flat steel products is higher in developed countries than in developing countries, with all research confirming this.

For instance, in Japan, the usage rate of coated material is 45 percent, while uncoated material (hot and cold rolled steel) usage stands at 55 percent. In EU-15 countries, the percentage of coated usage stands at 40 percent, whereas the uncoated usage rate is 60 percent. On the other hand, coated usage is 20 percent in the Middle East against 80 percent usage of uncoated steel, and, lastly, coated usage stands at 12 percent in the CIS.

Meanwhile, ex-China HDG coil offer prices to Europe have registered an uptrend, just like other flat steel products of the the same origin, and so it seems that the Chinese producers may see a loss of competitiveness as regards HDG coils. There were serious tonnages exported from China to Europe in September and October, when ex-China HDG offer prices indicated a considerable decline. However, the increasing ex-China prices are making it difficult to export to Europe now.

In Italy, HDG coil prices have been standing at €420-430/mt ex-works, with base prices at €470/mt ex-works in Portugal. Meanwhile, ex-India HDG coil offers are at €525/mt CFR southern Europe for 0.5 mm 100 gr/m² material. Buyers in the southern European countries in question are very careful about buying imports due to the lower domestic price levels compared to the import prices and also due to the approach of the New Year.