As expected, the majority of the Russian and Ukrainian producers pushed their domestic flats prices upward for April production in an attempt to compensate for the increased costs of raw materials, transportation and energy.

Compared to the March production prices, major Russian steelmakers such as MMK, NLMK, Mechel and Severstal increased their prices for flat products by 12-19 percent on average, depending on product specification and delivery region. Meanwhile, the increase implemented in the Ukrainian domestic market for April production by domestic steel producers ranged between 11 and 25 percent depending on product specification and delivery region.

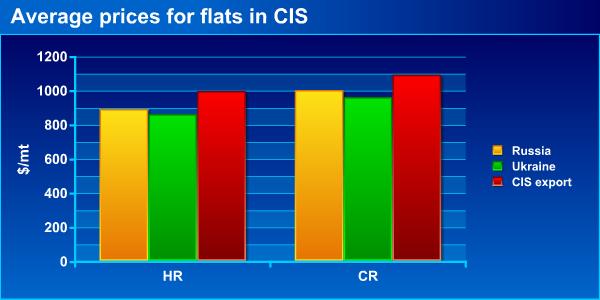

Although the performed increases are in line with trends in the international market, where the prices for CIS origin flats have increased by an average of $200/mt in a month, the domestic markets in Russia and Ukraine are far from being ready for such price hikes.

The domestic market players in the two countries in question report that, due to the favorable situation in the international flats market, a scarcity of available material has been created in their domestic markets. As a result, the domestic prices for flat products have skyrocketed. However, despite the high level of demand, buying activity is rather moderate as domestic consumers are lacking available financial resources to purchase material at the offered prices. Furthermore, the lack of available cash in hand is an issue which not only affects the end-users but also the large trading companies.

*- CIS export price offers dated beginning of April

**- Russian and Ukrainian domestic markets are on ex-works basis, excluding VAT

So far domestic traders in Russia and Ukraine have tried to reduce the full impact of the producers' price hikes on the domestic markets by implementing their increases only partially, in an effort to maintain a moderate level of buying activity. However, they won't be able to restrain the prices forever given the continuous nature of the domestic price rises. This trend could be seen starting from the second half of March when the increases in the HR and CR retail prices in the Russian market started to reach Ruble 1,000/mt ($41/mt) and Ruble 1,400/mt ($57/mt) respectively; meanwhile, in Ukraine prices for HR went up by UAH 200/mt ($40/mt) and CR prices rose by UAH 245 ($49/mt) within a single week.

Although the price increase trend is expected to continue in May as well, since several steel mills have already announced plans to increase domestic flats prices by 15-25 percent in that month, it is highly doubtful that the domestic markets in Russia and Ukraine will accept any further price rises.