While US plate demand has remained weak, inventory levels have been slowly shrinking, which, coupled with the recent scrap uptick, may lead domestic plate mills to slightly increase prices within the next week.

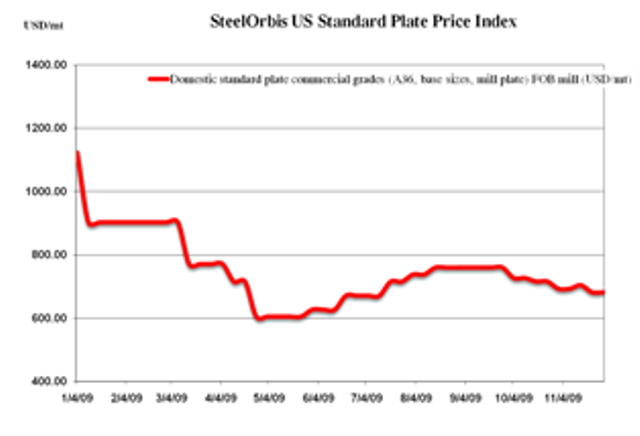

Currently, most domestic plate mills are offering to customers at around $34.00 cwt. to $35.00 cwt. ($750 /mt to $772 /mt or $680 /nt to $700 /nt) FOB mill (for commercial grades -- A36, base sizes, mill plate); however, the mills only can get these premium prices with order-to-size sizes, particularly for fabricator purchases. For most stock sizes, the majority of spot transactions are actually taking place at approximately $30.00 cwt. to $31.00 cwt. ($661/mt to $683/mt or $600/nt to $620/nt) FOB mill. Larger, long-term clients with significant tonnage may even still find it possible to negotiate a deal just under the $30.00 cwt. ($661/mt or $600/nt) benchmark. While it may be unconventional to contemplate an increase when spot prices are over $4.00 cwt. ($88/mt or $80/nt) lower than your offered prices, domestic mills figure an increase could help firm up their spot offers a bit, even if a large gap from offered to booked prices remains.

US plate demand is still very poor. For several months now, distributors and traders have complained about the excess inventory lying on the ground at warehouses and at the ports. However, even with the ongoing lull in demand, due diminished buying both domestically and imports, inventory levels have continued to be slowly depleted. According to the most recent Metal Service Center Institute (MSCI) monthly shipment and inventory report, while daily shipments of plate inventory decreased from 11,500 nt in September to 10,700 nt in October, the lowest tonnage since April, service center inventory levels still decreased, from 713,000 nt in September down to 654,000 nt in October .As a result, the average monthly inventory overhang stood at only 2.8 months by the end of October. Judging from these inventory levels, people are going to need plate sooner or later, and some distributors have informed SteelOrbis that although bookings have not yet increased, there has been a slight uptick in quote inquiries. Distributors are hoping that if demand can just pick up slightly, inventory prices may begin to slowly climb.

Furthermore, regardless of the large gap between domestic mill offers and spot transactions, domestic mills do not have much to lose at this point by attempting a price raise, due to the continued absence of pressure from import sources. The atmosphere of the import plate market hasn't changed much since the beginning of the second quarter, as the majority of traders have very little interest in plate imports. If their customers need product right now they can still easily pick up some cheap tonnage lying on the ground at most coastal ports, especially in the Gulf. Meanwhile, there is not much interest for deliveries later in the first quarter because market conditions are too volatile. Domestic prices could go up and fall back down by then. Aside from some niche sizes here and there, import plate offers will not receive serious consideration from buyers until the excess port inventory is depleted, which will most likely not be any time before the end of the first quarter.

Further illustrating the current state of the import plate market, license data from the

US Import Administration demonstrates that total import tonnage of cut-to-length plates decreased further in November from October at 35,948 mt (preliminary census data) to 22,703 mt. Canada, Finland and Germany were the only sources to export over 1,000 mt of plate tonnage to the US in November; at 10,598 mt, 4,366 mt and 1,567 mt respectively.