The calm in the Turkish flats market did not disappear even after Erdemir's price hike. Despite this, there has not been any significant decline in the prices of imported materials in the Turkish market. The reasons for this can be indicated as;

- The significant increases in the prices of raw materials

- The local markets of Russia and Ukraine are stronger as compared to the local markets of other countries

- The rise in freight rates

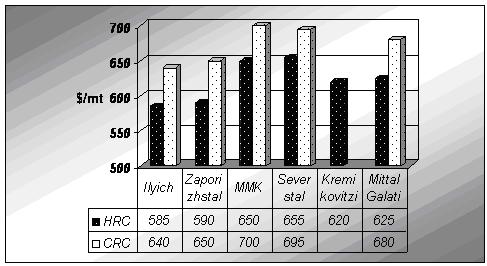

Import prices in the Turkish domestic market are as follows:

• The above prices, which are on CFR Turkey basis, are effective for January shipments.

• Import duty on flats in Turkey is five percent. However, if the five percent duty collected is below €29, then a minimum duty of €29 per ton is applied. The import duty is effective for both hot rolled and cold rolled flat steel products (for llyich, Zaporizhstal, Severstal and MMK).

• There is no import duty applied on Kremikovtzi and Mittal Steel Galati products.

Ukrainian steelmaker Ilyich is offering hot rolled coils at $585/mt CFR Turkey for late January shipments. On the other hand, the producer is offering cold rolled coils at $640/mt CFR Turkey, also for late January shipments. However, there have not been many import arrivals for prime quality materials in the last few months. The main reasons for this may be indicated as; unabated strength of Ukrainian local market, rising freight rates and continuing weakness of demand in the Turkish market. The fact that Ilyich asked $545/mt FOB for October production hot rolled coils has made imports difficult. Zaporizhstal, another Ukrainian steelmaker, is offering hot rolled coils at $590/mt CFR Turkey for late January shipments. On the other hand, the producer is offering cold rolled coils at $650/mt CFR Turkey, also for late January shipments. However, the fact that actual sales are being concluded at prices $5-10/mt below the offer prices is another factor making imports from Ilyich difficult. However, it would also be difficult to say that there have been many inbound materials from Zaporizhstal over the last two months.

Russian steelmaker MMK is offering hot rolled coils at $650/mt CFR Turkey for late January shipments. On the other hand, the producer is offering cold rolled coils at $700/mt CFR Turkey, also for late January shipments. However, it is heard that actual sales are being concluded at prices $25-30/mt below the announced prices, which have not changed as compared to the prices announced last month.

Severstal, another Russian steelmaker, is offering hot rolled coils at $655/mt CFR Turkey for late January shipments. On the other hand, the producer is offering cold rolled coils at $695/mt CFR Turkey, also for late January shipments. The producer, who did not make any changes in its hot rolled coils prices, has lowered its cold rolled prices by $40/mt. In the wake of this reduction, a very interesting competitive environment has emerged in Turkey's CR market.

Bulgarian steelmaker Kremikovtzi is offering hot rolled coils at $620/mt CFR Turkey for late January shipments. On the other hand, the producer is offering hot rolled sheets at $635/mt CFR Turkey, also for late January shipments. The CR materials of this producer are still out of the Turkish market.

The main reasons for the recent position of Bulgarian origin materials in the Turkish market are:

- freight rate advantage

- import duty advantage

- quality of these materials is accepted by Turkish buyers

Romanian steelmaker Mittal Steel Galati is offering hot rolled coils at $625/mt CFR Turkey for late January shipments. On the other hand, the producer is offering cold rolled coils at $680/mt CFR Turkey, also for late January shipments. The prices are base prices and subject to ArcelorMittal extras. The major point which drew attention with this producer's price announcement is that it has kept its HRC prices unchanged, while it has reduced its CRC prices as compared to the previous month. A healthy CRC market is the target of many Turkish mills.

For the coming period, it is expected that prices will go up for December and January orders. The prices increases expected in the European market in the first quarter of 2008 will affect the Turkish market. Despite the low demand in the local market, the fact that end-users have not purchased many materials in recent months and that they have deferred their purchases till next year gives the impression that demand in the first quarter of 2008 will be higher than it is at the moment.