While the US flat rolled market continues to be dominated by domestic mills, lackluster demand is still forcing producers prune more production and ease on pricing.

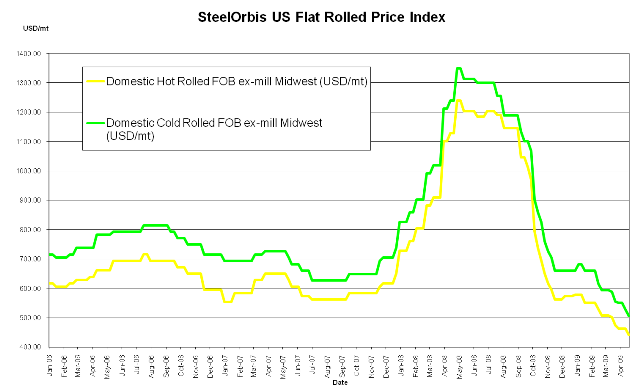

Generally, domestic hot rolled coil (HRC) offers slid another $1.00 cwt. ($22 /mt or $20 /nt) over the past week, bringing most offers within a range of $19.00 cwt. to $21.00 cwt ($419 /mt to $463 /mt or $380 /nt to $420 /nt) ex-mill in the Midwest. While most customers were able to negotiate offers within this range on significantly sized orders last week, it appears that smaller, "filler" orders are now able to be booked at this level as well. Furthermore, domestic mills remain on the offensive, and customers still trying to get the best deals on orders of significant tonnage may be able to receive additional discounts, pushing this range down even a little further.

Meanwhile, the price range for domestic offers on cold rolled coils (CRC) has also decreased by about $1.00 cwt. ($22 /mt or $20 /nt) since last week and most offers can now be mostly found for around $22.00 cwt. to $24.00 cwt. ($485 /mt to $529 /mt or $440 /nt to $480 /nt) ex-Midwest mills, reestablishing about a $1.00 cwt. gap between most HDG sheet base prices.

One potential light in an otherwise bleak market is the fact that domestic busheling scrap prices recently increased by about $50 /lt. Ordinarily, this could signify some price stabilization in the finished market, but demand just hasn't returned back to anywhere near to where it has to be for an upward correction to occur for flat rolled products. Furthermore, the recent idling of much of the production of the US auto industry's giants, Chrysler LLC and General Motors, has provided more devastating blows to flat rolled demand, with AK Steel, a steelmaker which supplies mostly to the auto industry, now predicting a second quarter operational loss that is about $25 million to $30 million dimmer than originally anticipated.

On the import side, foreign HRC offers to the US continue to be controlled mostly by Mexico and Venezuela, who both remain at about $18.00 cwt. to $20.00 cwt. ($397 /mt to $441 /mt or $360 /nt to $400 /nt). Mexican offers are delivered to the US border crossing, while Venezuelan offers are duty-paid, FOB loaded truck in US Gulf ports. However, Mexican mills, supported by their domestic market, are becoming less aggressive and are less likely to continue following domestic US offers downward, while Venezuela cannot produce orders as quickly as US domestic mills can and therefore have a difficult time competing.

Meanwhile, most CRC import offers to the US remain quiet and trended sideways from last week. Most offshore CRC mills are becoming increasingly reluctant to match or beat US domestic offerings, and even if they can generate interest with a low price, they cannot compete with US mill lead times. US mills are currently pursuing orders for June delivery, while countries such as Taiwan and India are currently pursuing orders all the way out for September deliveries, which just doesn't make sense for buyers right now in this market. Nonetheless, Mexican CRC offers remain the most attractive, price-wise, at $23.00 cwt. to $25.00 cwt. ($507 /mt to $551 /mt or $460 /nt to $500 /nt) at the US border crossing. Argentinean offers are at $24.00 cwt. to $26.00 cwt. ($529 /mt to $573 /mt or $480 /nt to $520 /nt) duty-paid, FOB loaded truck in US Gulf ports. Meanwhile, Brazilian, Chinese and Indian offers continue to be a little higher at about $25.00 cwt. to $27.00 cwt. ($551 /mt to $595 /mt or $500 /nt to $540 /nt) duty-paid, FOB loaded truck in US Gulf ports.

Recently released license data from the US Department of Commerce show that HRC imports to the US decreased significantly to 105,749 mt in April, from an estimated 140,557 in March. While Korean imports remained consistent in April from March, at 27,546 mt and 27,108 mt respectively, Canadian HRC imports dropped drastically from 70,746 mt in March 31,577 mt in April. Mexican HRC imports declined from March to April, at 17,965 mt and 10,963 respectively.

Meanwhile, CRC imports maintained increased slightly from 85,861 mt in March to 91,753 mt in April. This was also an increase from the 77,235 mt imported in April 2008. The top three CRC import sources for the US during April were Brazil, Russia and Belgium, at 20,585 mt, 17,325 and 13,050 mt respectively.

US mills maintain that there are still too many imports coming into the country even though the volumes have dropped some. At the AISI meeting in Phoenix, mills complained that certain trading partners, headed by China, are not playing by the rules, and are dumping and manipulating their currency. AISI member producers implied that, as a result of these trade practices, more antidumping complaints will be prepared and filed this year.