The sluggishness seen in the Turkish flats sector in the previous three weeks continued to be observed during last week. It is unlikely that the recovery anticipated with the conclusion of Ramadan will heal the general stagnation in the sector. Looking at the developments in the global steel sector, very important changes are observed in the Far Eastern market. These days China's production has been continuing at full capacity, while its consumption has shown a significant decline. This situation has led to difficulties for firms which previously stockpiled massive flat steel purchases from Russia and Ukraine. As a result, Russian and Ukrainian origin ready-stock materials are now being offered for export at levels of $480-500/mt FOB. These offers have achieved a considerable number of sales to the Far East, Europe and the Middle East, despite the high freight costs in this current period. It seems that Russian and Ukrainian producers, who generally conclude flats sales to the markets in question, will experience difficulties due to this situation, leading most likely to a slight correction of their price levels, if not to a more rapid downtrend.

Should the Russian and Ukrainian steelmakers lower their prices, in the coming months a price reduction will become inevitable for the Turkish producers; i.e., for Erdemir, which increased its flats prices by $30/mt last week, and for Isdemir, another mill which produces by using iron ore. After all, the main reason for the high price levels in the local Turkish flats market is lack of material, not robust demand. The tax applied on import flat steel products protects the Turkish producers. If the absence of this import tax, the Turkish producers, which are located far from any rich iron ore deposits and which thus buy in iron ore supplies at higher price levels compared to most of their rivals, would have experienced more difficult times. On the other hand, however, some firms which purchase finished steel materials for processing are experiencing problems in obtaining supplies of certain materials they need due to the import tax.

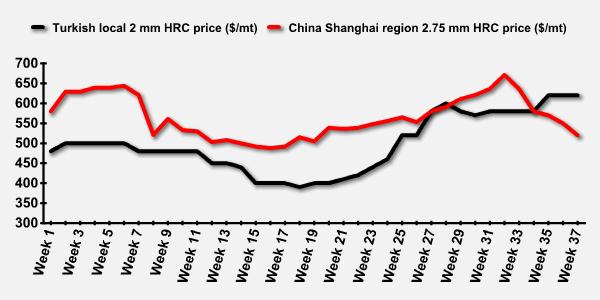

The graph below shows the HRC price trend in the Chinese market (Shanghai) and gives an idea of the parallelism between the Chinese and Turkish flats markets. It is seen from the graph that the two market trends which had been parallel have in recent weeks gone in different directions. It seems impossible that the decreasing price trend registered in China, the world's biggest steel producing country, will not be reflected indirectly, if not directly, in the Turkish flat steel market where demand is currently low.