US flats mills appear poised to continue raising list prices into fourth quarter; however, the upward pricing momentum could begin losing some steam.

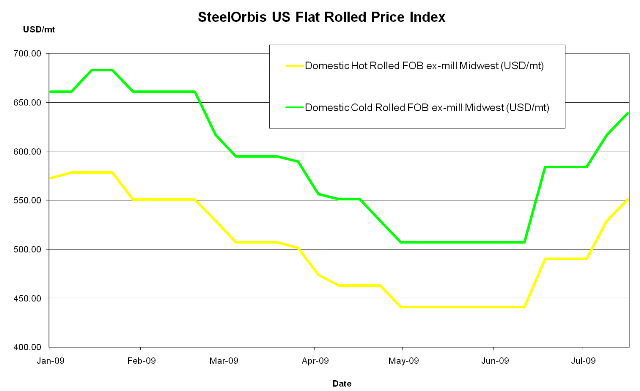

While the price range for domestic hot rolled coil (HRC) spot offers has not changed from our report last week, with most offers still ranging from approximately $23.00 cwt. to $25.00 cwt. ($507 /mt to $551 /mt or $460 /nt to $500 /nt) ex-mill in the Midwest, the majority of spot offers are at the higher end of the range. However, HRC appears to have the weakest activity right now out of the primary flat rolled products. As the base flat rolled product on which all other flat rolled products are produced from, weakness in HRC could be a cause for concern moving forward.

Meanwhile, US cold rolled coil (CRC) spot prices have also remained fairly consistent with last week's offers at around $29.00 cwt. to $31.00 cwt. ($639 /mt to $683 /mt or $580 /nt to $620 /nt) ex-mill in the Midwest. CRC demand has been more solid than that for HRC, and has pushed many offers to the $30.00 cwt. ($661 /mt or $600 /nt) mark and above.

Furthermore, some flat rolled buyers have informed SteelOrbis that US Steel has notified them that they will raise flat rolled spot prices by another $1.50 cwt. ($33 /mt or $30 /nt) in October. However, flats market heavyweight, Nucor, hasn't made any October price indications yet, and most mills are still booking for early September. SteelOrbis understands that USS is particularly busy contract business from the automotive sector, which is likely what allowed them to make such a seemingly premature price move on spot offers.

While overall US flat rolled spot prices could rise in October from September levels, that would make for four consecutive months of price hikes, without much improvement in demand. The lackluster demand, combined with some buyers growing skeptical that another mini-bubble may be forming, could potentially take the legs out of the market by the end of the year, especially as business typically slows down further in the fourth quarter. Still, as long as scrap prices remain fairly solid, no major drops on the price side are expected.

As for imports, there are still no significant tons being booked, and overall flat rolled imports are expected to be considerably down this year. The US flat rolled market is still very much a "domestic game." HRC offers to the US are still very quiet, as Mexican mills are sold out through at least September. Turkish mills are still sitting on the sidelines.

Traders continue to see some CRC import offers, although none are really worth entertaining. There is just not enough buyer interest, prices are too high, and there is still too much uncertainty about the market's future to gamble on long import lead times. The most competitive offers are currently from Brazil, at approximately $28.00 cwt. to $30.00 cwt. ($617 /mt to $661 /mt or $560 /nt to $600 /nt) duty-paid, FOB loaded truck in US Gulf ports. Meanwhile, a couple Asian sources continue to offer CRC to the US at uncompetitive levels. Neither China or India have altered their offerings in recent weeks, as China continues to offer CRC to the US for around $32.00 cwt to $34.00 cwt. ($705 /mt to $750 /mt or $640 /nt to $680 /nt) duty-paid, FOB loaded truck in US Gulf ports, while India's offers are still ranging from approximately $32.00 cwt. to $33.00 cwt. ($705 /mt to $728 /mt or $640 /nt to $660 /nt) duty-paid, FOB loaded truck in Gulf ports.

Furthermore, license data from the US Department of Commerce demonstrate that HRC exports to the US decreased for the fourth consecutive month in June, totaling about 88,670 mt, down from 102,875 mt in May. While Canadian, Mexican and Australian HRC imports all increased from May, to 40,044 mt, 15,787 mt and 12,523 mt, respectively, in June, Korean imports decreased drastically, from 29,077 mt in May to only about 7,432 mt in June.

CRC imports also decreased for a fourth consecutive month in June, totaling 44,221 mt, down from 52,328 mt in May. The top five CRC import sources for the US in June were: Canada, at 14,167 mt; Brazil, at 4,426 mt; Mexico, at 5,359 mt; Netherlands, at 3,967mt; and United Kingdom, at 3,432 mt.