Among the main issues Turkey’s scrap market faced in 2023 were the massive earthquakes that hit Turkey’s southeastern region in February, increases in production costs, declining steel demand in both local and export markets, Turkey’s presidential elections, the rapid depreciation of the Turkish lira which led to a change in the government’s monetary policy and rising interest rates in the second half of 2023, shrinking scrap availability in the supplier regions, and higher competition from alternative buyer regions.

Turkey’s overall scrap imports in the January-September period of 2023 totaled 13,881,320 mt, lower compared to 16,787,103 mt in the same period of 2022, while the overall tonnage in the full year of 2022 amounted to 20,814,778 of scrap. The highest monthly import scrap tonnage bought by Turkey in 2023 was recorded in February, with a total of 2,337,424 mt. In February and July 2023, Turkey’s scrap imports surpassed the monthly tonnages seen in the previous year.

According to the data for the first eight months of 2023, the leading scrap supplier to Turkey was once again the EU, which accounted for 61.7 percent of Turkey’s imports with a total of 8,567,955 mt. Meanwhile, Turkey bought a total of 3,142,109 mt of scrap from the US and 1,084,575 mt from the UK in the given period.

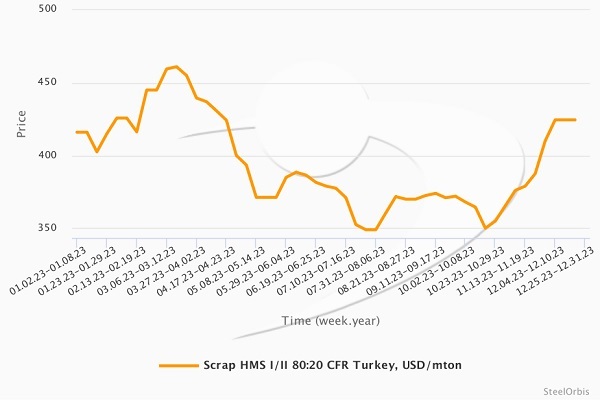

Turkey’s import scrap market made a positive start to 2023 due to the ongoing tight supply conditions after the holidays. Collection prices were moving up in supplier regions, while Turkey still needed to buy for January shipments. However, the real push on prices came after the February 6 earthquakes which hit ten cities in southeastern Turkey, which produces almost 30 percent of Turkish steel. Along with the huge impact on buildings and infrastructure, Turkish mills in the region stopped production after the earthquakes in order to examine the impact on their own plants and on ports and to evaluate how their workers were affected.

The average HMS I/II 80:20 scrap price in Turkey was at $425.75/mt CFR on February 6, subsequently declining to $416.25/mt CFR in the third week of February. However, Turkish mills’ return to the steel and scrap markets was quicker than the initial expectations. Fears of cancelations of deep sea scrap cargoes dissipated quickly and Turkish mills voiced their intention to get back to work as soon as possible after prioritizing their workers’ safety and welfare, as well as structural and technical investigations. Accordingly, the import scrap market became active again, with deep sea scrap quotations increasing to $445/mt CFR Turkey on average, faster than most players had anticipated. The slower scrap flow to export yards was one reason why prices increased, but the main factor was lively demand. The Turkish government’s plans to rebuild the earthquake-hit region within a year also supported sentiments, causing mills to prepare to meet steel demand. At the end of February, Turkish mills started to show some resistance to higher scrap offer levels, while the number of offers from suppliers to Turkey had also increased. As a result, Turkey’s import scrap prices were in the range of $440-450/mt CFR when February ended. Meanwhile, construction works in the region were postponed after warnings from experts stating that buildings would be compromised once again if the government decided to move before the ground had settled after such major quakes.

The peak level for Turkey’s import scrap prices in 2023 was seen on March 13, with the benchmark HMS I/II 80:20 scrap prices hitting $461/mt CFR on average, $45/mt higher than the levels recorded on January 1. The impact of the earthquakes was clearly weaker than the impact of Russia’s invasion of Ukraine. After Russia’s began its offensive on February 24, 2022, Turkey’s import scrap prices surged from $464/mt CFR recorded early in 2022 to $658/mt CFR on average by the end of March.

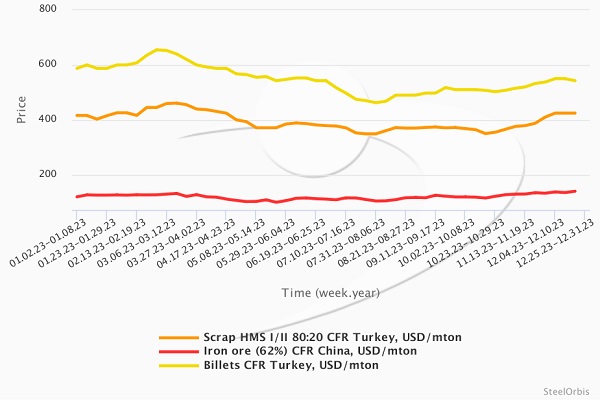

When it was understood that the rebuilding of the earthquake-hit region would not be as easy or carried out as quickly as initially thought, deep sea scrap prices in Turkey indicated a sharp fall up to May. By May 8, deep sea scrap prices in Turkey were at $371/mt CFR on average. In the second half of March, Turkey’s long steel market was not supported by demand, whether domestic or export. China was aggressive with its hot rolled coil (HRC) offers via traders, while billet prices were also softening. Also, on March 22, during an online event held by the Turkish Steel Foreign Trade Association, several market players indicated that reconstruction works in the affected region had not started yet. The total number of tenders held by the government by then was 77, with approximately 41,950 housing projects covered by these tenders. However, the total number to be rebuilt was estimated at around 441,000. [The official number announced by the relevant ministry later was 653,178 in total, including country houses and damaged residential buildings. At the end of 2023, the ministry in question announced that building projects for 200,000 residences had been started since the earthquakes]. Other significant issues were the high loan interest rates and the tightness of credit availability in Turkey. As a result, benchmark HMS I/II 80:20 scrap prices in Turkey closed March at $435-444/mt CFR, on average 1.23 percent lower than the levels recorded at the beginning of March.

The $40/mt decline in Turkey’s import scrap market in April was caused by the lack of demand for Turkish steel, with finished steel and semi-finished steel imports being offered to Turkey at more attractive prices, by the financial problems faced by all players in the domestic market, and by the uncertainties ahead of the presidential and parliamentary elections due to be held in Turkey on May 14. The possibility of a second round in the presidential election, which would take place on May 28, was also a source of additional uncertainty for trade. Without a decent volume of exports, maintaining cash flow was difficult for all Turkish mills, who were performing weakly in the export markets. Turkish mills were not just keen to avoid taking risks with scrap purchases, but also with other alternatives such as billets. The mood and price trends for hot rolled coil (HRC) globally were characterized by a certain pessimism. The continuous price fall in Asia put pressure on other markets. The downtrend in the global billet market continued. There were not many alternative markets for scrap suppliers to consider. As a result, deep sea scrap prices in Turkey started to fall at a significant pace as of April 23 and closed the month at $400/mt CFR.

The elections had a big impact on trading in Turkey during May. Following the parliamentary and presidential elections held on May 14, no candidate obtained the 51 percent of the vote required for an outright victory in the presidential election and so a second round was needed, which took place on May 28. Between May 8-28, Turkey’s import scrap prices anchored at $371/mt CFR on average. An upward push on prices came from the suppliers’ side. Due to collection costs, sellers increased their offers to Turkey and remained firm. In the end, a $18/mt rise was observed in the market, to be corrected quickly to a lower level.

Starting from June 11, deep sea scrap prices were once again under pressure. As US-based suppliers started to offer lower levels to Turkey, European scrap sellers were forced to follow suit. At the end of the month and ahead of the Feast of Sacrifice holiday on June 28-July 1, Turkish mills’ needs for deep sea scrap had almost been met. Following the decision of the Turkish central bank on June 22 to increase interest rates to 15 percent from 8.5 percent, the Turkish lira depreciated to 25.46 to the US dollar. [In 2023, the Turkish lira depreciated against the US dollar from 18.68 to the dollar on January 1 to 29.40 on December 27.] While this depreciation made sense considering that the initial expectations for the new interest rate varied at around 25-30 percent, the first response of Turkish mills was to close their domestic sales.

The reasons for the ongoing declining trend in July were obvious. Turkish mills were not receiving enough demand from their local market to support the prices of steel (mainly rebar) and they had no competitive edge to enable them to focus on exports instead. As a result, Turkish mills, forced to rely on their domestic market, decided it was time to cut prices to generate more sales. With rebar prices starting to fall, the downward pressure on import scrap prices increased. Turkish mills citing their costs and financial difficulties started to mention the likelihood of production cuts in August. Some producers mentioned that their customers were also experiencing difficulties accessing money, raising questions over whether they would be able to receive the goods they ordered and make payments. Against this backdrop, Turkish producers were very careful and were in no rush to conclude deep sea scrap bookings. The situation in the billet segment did not support the scrap market either. Meanwhile, demand coming from construction projects was slower than usual in July. On July 24, Turkey’s deep sea scrap prices fell to $349/mt CFR on average, which eventually represented the bottom level of import scrap prices in 2023. In comparison, the volatility of Turkey’s import scrap market was less pronounced than it had been in 2022. While the gap between the peak and bottom levels in 2023 was $112/mt, it was $333/mt in 2022. Also, the price volatility in 2023 was lower than in 2021 [$127/mt] and 2020 [$260/mt].

In August, Turkish mills accepted higher scrap price levels as they understood that scrap flow to export yards was slow. Despite this recovery of prices and the subsequent stable trend, prices took another dive in October. On August 24, the Turkish Central Bank increased interest rates by 750 basis points. This came as a shock as the highest increase margin was expected to be 250 basis points. The Turkish lira regained 5.36 percent of its value within a few hours. In these circumstances, trading almost stopped in Turkey, with market players evaluating their next move. On September 21, Russia announced its decision to implement export duties on certain categories of products, including steel and raw materials. At first, this development came as a shock to the market, but in the end it had little real impact. The most important development for Turkish steelmakers in September was the electricity price hike announced in Turkey on September 28. Electricity prices for industrial usage in the country were increased by 20 percent as of October 1. This announcement was followed by a further announcement raising natural gas prices, also by 20 percent. The new hikes in natural gas and electricity prices further exacerbated the difficulties facing Turkish steel producers, who were already facing high production costs and reduced competitiveness in export markets.

In October, it quickly became clear that Turkish mills were planning to exert significant pressure on deep sea scrap prices, citing the lack of steel demand and their low [non-existent in some cases, according to sources] profit margins. The absence of scrap demand received from Turkey led to a drop in deep sea prices, which had started the month at $368/mt CFR, to $364/mt CFR in a first step, with both being average prices for benchmark HMS I/II 80:20 scrap. On October 20, benchmark scrap prices in Turkey settled at $350/mt CFR on average, which became the bottom level very quickly as sellers resisted any further decline.

During the week ending October 22, deep sea scrap prices started to move up mainly due to increasing scrap collection prices. The increase in deep sea scrap prices at the end of October was considered to be on the sharp side and came as a surprise to many sellers and buyers as prices hit $360/mt CFR on average. At the beginning of November, several Turkish mills were seeking cargoes for December shipment, in particular following the recent price increases. In the US, there was the positive impact of the agreements the United Auto Workers Union (UAW) signed, which ended the weeks-long strike against Detroit’s automakers. Collection prices in the EU were also firm and at high levels. Towards the end of November, Turkish mills realized that sellers were not lowering their prices but were instead increasing them sharply. The reasons for the price increases were the cold weather conditions, the lack of sustainable scrap flow to yards, Turkey’s ongoing demand for scrap (now for shipment in January), and the approaching holiday season in the scrap supplying regions. The increases in global coal and iron ore prices added to the positivity surrounding the scrap market, as did the good performance observed in the flat steel markets. Flat steel producers were more willing to accept higher scrap offers, thereby helping to push up the market at a fast pace. At the end of November, benchmark scrap prices in Turkey were at $388/mt CFR on average.

December was also characterized by a price surge. As Turkish mills continued to book deep sea cargoes to cover their needs for December and January shipments before the holiday season started in supplier regions, scrap prices increased to $425/mt CFR on average, moving up by $37/mt. In addition to the lack of supply and the low number of offers shared with Turkish mills, freight rates also contributed to the price rises. At the beginning of December, it was reported that higher freight rates were causing postponements of shipments of previous deals, potentially creating a need for prompt shipments. However, several market sources reported that there were not many offers available to fill potential gaps in shipments. Iron ore and coal prices were supporting the increases in the scrap segment. It was quickly understood in early December that unless all Turkish mills - both long and flat steel producers - took a step back from the scrap market, deep sea scrap prices would move up. In the first eight days of December, 25 deep sea scrap deals were disclosed to the market, signaling that Turkish mills had almost completed their bookings for January shipment. Approximately seven of the deals were for February shipment. Turkey’s import scrap market then retreated into a very deep silence. After almost two weeks of inactivity, new scrap deals from the US and the EU indicated a $10/mt fall in prices. This decline had been expected by all market players since the number of offers in the market was rising. On December 27, benchmark prices in Turkey stood at $414.5/mt CFR on average.