Mr. Carvalho stated that steel overcapacity is having negative effects on markets and emissions, by causing the former not to function properly - due to bad organization in terms of resources and supply - and the latter to grow uncontrollably, having implications for the climate.

Analyzing the current steel demand situation, Mr. de Carvalho stated that the global steel demand situation is weak due to the slowdown in world economic growth, high inflation, and interest rates. Although global steel demand is slowly recovering, it is still not growing fast enough to keep up with the overcapacity growth rate.

On the other hand, de Carvalho noted, steelmaking capacity keeps rising mostly in technologies that emit higher CO2 on average than others. In the meantime, current trends are widening the gap between capacity and demand, which might result in a flood of relatively high-carbon steel exports in international steel markets in the next few years, with a squeeze on steelmakers’ profitability.

The OECD’s outlook for steel capacity expansion until 2026 sees Asian countries in the first place - especially ASEAN and India - with a growth of almost 90 million mt. The negative aspect is that around 65 million mt will still be produced using very polluting BOF technologies, whereas the rest of the world’s production is becoming more and more EAF-based.

The potential increase in capacity amounts to 158 million mt in 2024-26, and the gap between capacity and demand is more than 500 million mt. Last year, the global excess capacity - with China as the major producer - was equal to 504 million mt, which is higher than the combined production of major global steel producers and the global steel trade, that involved 282 million mt. If it keeps going like this, China risks wiping out all the other countries’ production in the global market, explained De Carvalho.

Impacts of excess capacity on world steel markets

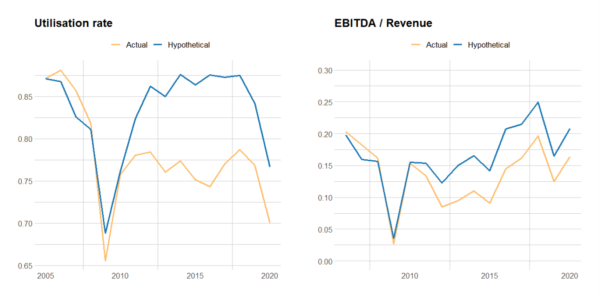

In a study released on Friday, March 1, the OECD illustrated an empirical model to study the impacts of excess steel capacity on the world steel markets, which can be summarized with a quote from Mr. de Carvalho: “Excess steel capacity is causing non-sustainable profitability levels, and the steel industry needs better operating profit ratios in order to improve low-carbon steelmaking.” In the above mentioned study, the OECD also hypothesized what would have happened if global excess capacity had not surged, concluding that utilization rates and revenues would fall at the beginning, but in the end they would be at healthy levels - higher than the actual ones.

The preliminary results of the study show that steel stock prices also fell below predicted values in most cases, indicating a negative impact on profitability.

To conclude, global excess capacity is causing steel producers to have lower aggregate domestic market shares, a decrease in domestic utilization rates, reduced revenues and profits, as well as inconclusive impacts over other countries’ steel exports.

The changing nature of excess capacity

De Carvalho explained that the carbon intensity of excess capacity is also growing and at the same time trade policies are increasingly focusing on the carbon footprint. That is why excess capacity is hitting the steel industry with a wrong timing, as the latter is trying to focus on decarbonization. This could lead to accelerating government subsidies to support green steel in impacted countries, policies aiming to boost domestic supply of raw materials, and a greater focus on raw materials on the pathway through decarbonization.

Last year, the GFSEC signed a new three-year mandate and started a substantive work aimed to handle this problem, also outreaching to non-member Asian countries who want to participate, as the overcapacity issue is affecting them as well.

In the third quarter this year, the GFSEC will hold a ministerial meeting to develop tangible options to address overcapacity.