Turkey’s steel industry has been struggling due to its weaker competitiveness in the global markets, as the efficiency of the country’s production model has been under pressure from increased energy costs and financial problems during recent years. Turkey’s steel producers have been finding it hard to export amid high costs, while also seeing limited domestic trade. In 2023, the Turkish steel market failed to recover from the deterioration seen in 2022. Instead, 2023 brought even more challenges for the industry.

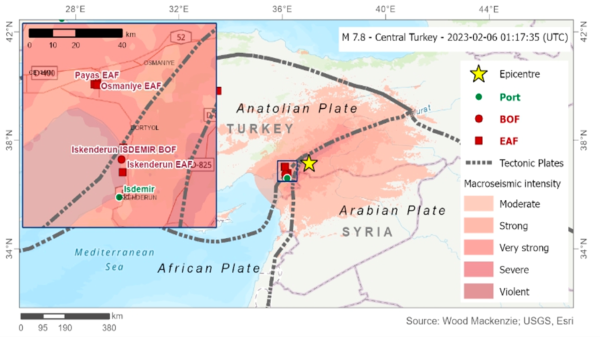

On February 6, two massive earthquakes caused widespread devastation across the Iskenderun and Osmaniye regions of Turkey.

About 12 mills in these regions which were located within 180 km of the earthquake's epicentre account for a third of Turkey’s steel production. The mills were not damaged materially. The producers temporarily halted operations to assess any damage to their production facilities or port terminals and logistics capabilities. The widespread destruction led to logistical problems (destruction of highways and power grids) and to reduced operations and stoppages at mills for two weeks.

The reconstruction activities in the earthquake-hit region in southern Turkey, announced at the end of March, did not get underway to any significant extent during the year due to economic reasons and the lack of finance. As a result, the Turkish domestic finished steel market did not receive the expected boost, while Turkish exports during the year remained slack overall. The country’s EAF-based crude steel production in 2023 declined by 4.5 percent to 23.98 million mt, while BOF-based crude steel production decreased by 5.6 percent to 9.45 million mt, both year by year, according to SteelOrbisʼ calculations.

Turkey has in recent years been facing serious economic strains, with its foreign exchange reserves depleted and the value of the lira tumbling. The new government forecasts show annual inflation rising to 65 percent by the year-end, before dipping to 33 percent next year, up from 24.9 percent and 13.8 percent respectively in the previous forecasts. GDP growth expectations have been cut to 4.4 percent this year and to 4.0 percent next year, still higher than most economists had expected. The Turkish lira has sunk to new record lows losing 45 percent in value year on year, falling to $1 = TRY 24.2 in 2023.

The Turkish lira sinks to new record lows in 2023

The Turkish central bank raised its key interest rate in separate announcements from 8.5 percent to 42.5 percent during the year, marking the country’s first interest rate hikes since March 2021 and the reversal of the previous loose monetary policy which had prioritized growth and investments. President Erdogan's previous drive to slash interest rates sparked a currency crisis in late 2021 and sent inflation soaring above 85 percent in 2022.

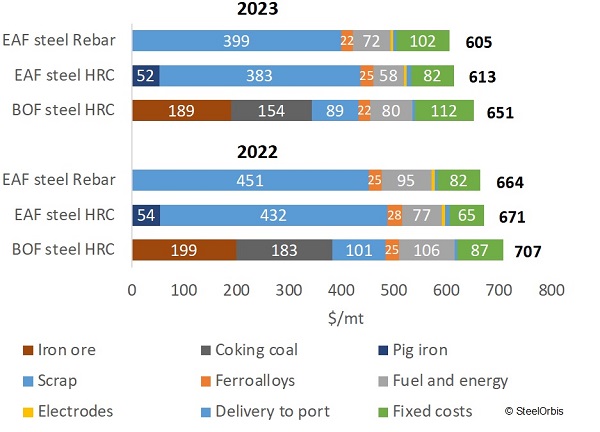

In general, prices in the steel markets declined in 2023. Prices of the various steelmaking raw materials decreased by a range of five percent to 15 percent during the year. Thus, for the Turkish market, steel scrap became cheaper by 11-14 percent, iron ore prices declined by five percent and coking coal prices fell by 14 percent. At the same time, the fixed costs per metric ton of finished rolled products increased significantly, by almost 25 percent, due to the decrease in production volumes.

Turkish finished products cost structure, EXW basis

In 2023, the production costs of Turkish EAF-based steel products decreased by an average of nine percent, and BOF-based steel product production costs declined by an average of eight percent. At the same time, prices of finished steel products in 2023 declined by larger margins than raw material prices and production costs. The higher rate of decline of finished product prices compared to production costs led to a significant decrease in Turkish producers’ margins in a market which already lacked strength.

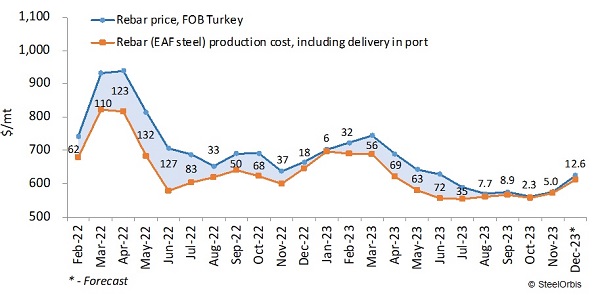

In 2023, average rebar prices on FOB basis decreased by more than $100/mt to $630-640/mt on average, and the margins of Turkish EAF-based rebar producers decreased to $30-35/mt on FOB basis from $70-75/mt in 2022, according to SteelOrbis’ data. Turkish HRC producers’ margins in their domestic market declined on average by around half during the year, falling from $130-150/mt in 2022 to $60-75/mt in 2023.

Margins of Turkish EAF-based rebar producers in US dollars, FOB basis

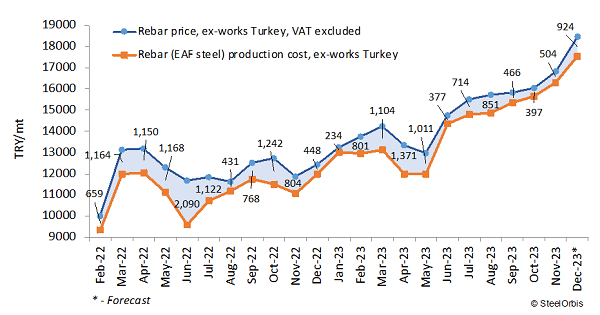

The higher Turkish lira-based raw material prices resulted in a steel production cost increase of TRY 3,300-3,500/mt to levels of TRY 14,000-14,500/mt in 2023 for EAF-based rebar production, but at the same time average rebar prices on ex-works basis increased by only TRY 3,000/mt to TRY 15,000-15,100/mt (ex-works basis, VAT excluded). The loss of value of the Turkish lira led to a decline of 25 percent in the domestic margins of Turkish EAF-based rebar producers to TRY 700-800/mt, according to SteelOrbis’ data.

Margins of Turkish EAF-based rebar producers in Turkish lira, EXW basis

In general, 2023 for Turkish mills can be described as having been a more difficult year than the previous years. The unstable economic situation in Turkey, the depreciation of the national currency, and the loss of competitiveness provoked a significant decline in the production and trade of Turkish steel products. In 2023, finished steel and semi-finished steel product production in Turkey decreased by three percent compared to same period of 2022 to 70.4 million mt, while finished steel and semi finished consumption rose by seven percent to 76.9 million mt, according to SteelOrbis’ estimations. The growth in domestic market demand was offset by arrivals of imported material, mostly from Asia. Turkey’s steel imports rose to 17.3 million mt in 2023, from 15.1 million mt in 2022, while at the same time steel exports from Turkey dropped by 31 percent to 10.4 million mt, according to SteelOrbis’ data.

The Turkish lira has been steadily losing strength against the US dollar, though the depreciation of the currency may provide a window for Turkey to avail of opportunities in the export markets. But this will not apply in the case of the metallurgical industry, as Turkish mills depend strongly on imported raw materials for steel production and thus directly depend on the exchange rate of the Turkish lira. About 65-70 percent of the steel scrap needs of Turkish mills are imported and are purchased using foreign currency, mostly in US dollars. The current monetary tightening policy in Turkey is quite close to the level required to establish a disinflation course. Accordingly, the pace of monetary tightening will slow down and the tightening cycle is expected to be completed within a short period of time. The monetary tightness will be maintained as long as needed to ensure sustained price stability. Given the cumulative and delayed effects of monetary tightening, Turkey’s central bank will continue to determine policy decisions in a way that will create the monetary and financial conditions necessary to ensure a decline in the underlying trend of inflation and to reach the five percent inflation target in the medium term.