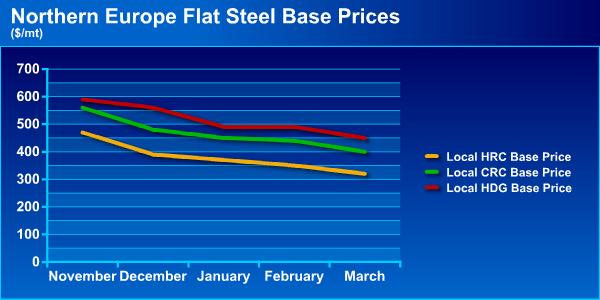

In January and February this year the local northern European production flat materials markets remained stable in general, apart for HRC which registered a decline of €20/mt. In the same period, imported flat materials posted a softening of €30/mt. In addition, market prices softened at but a slight rate in January, especially compared to the November-December period when local production flats prices in northern Europe fell by €74/mt while imported material prices declined by €76/mt. When February arrived, in line with predictions in our reports and with market players' expectation, flats prices in northern Europe showed greater stability thanks to factors such capacity reductions and cost pressure. However, this stable trend now seems to have run its course; so far in March domestic production flat product prices have fallen by €40-50 on average in the northern Europe markets, though imported flats prices in the markets in question have shown relatively greater stability softening by just $20/mt.

With lead times in Europe currently down to around four weeks from approximately eight weeks, local producers have been gaining the upper hand over importers. In particular, waiting for overseas arrivals is now a far riskier business due to changing price levels, fluctuating exchange rates and rapid swings in costs. For example, it is heard that previously concluded deals at normals price levels non-European sources are no longer attractive by the time the materials arrive at Antwerp port even though they are being sold at a loss.

Another important factor putting pressure on the flat steel price trend in Europe in March is the existence of sales activity being carried out at a loss in northern Europe by producers and distributors who need to ensure adequate cash flows. Combined with this, there are fears that the downtrend will continue. Everyone wonders how long producers and stockists will be able to sustain such sales activity.

End-users are currently abstaining from flat product purchases as they are concerned that prices will decline further. Indeed, expectations of a possible 40 percent reduction in iron ore and coking coal contract prices on the raw materials side help justify the above concerns. It is expected that the negotiations between the integrated steel producers and miners will last for some time yet and that the miners will hold out until the third quarter when the destocking process is likely to be closer to reaching a conclusion. However, those expecting the raw material prices to fall further should consider that the current contract prices may in fact remain effective for an extended time. For example, the European producers have reduced their capacities below the average global levels and they cannot start operating at new prices with the miners for 2009-2010 unless they first fulfill the tonnages for the 2008-2009 contracts. Thus, steel prices might not be affected immediately by changes in the iron ore contract prices. In addition, even after the new contract prices are agreed, an extra two months will be required (i.e. for transport, production process etc.) before changes are reflected in steel prices.

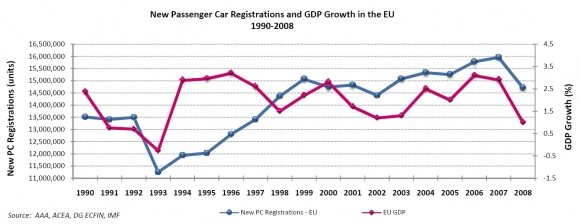

According to EUROFER's report, the flat product consuming sectors will be among those most seriously hit in 2009. Contractions of 13.7 percent, 8.7 percent and 7.1 percent are expected in 2009 in the automotive, pipe and metal product sectors respectively. Also, according to the European Automobile Manufacturers' Association (ACEA), automobile sales in Europe stood in the range of 16.7-17.7 million units annually during the ten years up to 2008. However, from January 2008 to January 2009, the sales figure in question decreased by 3.5 million.