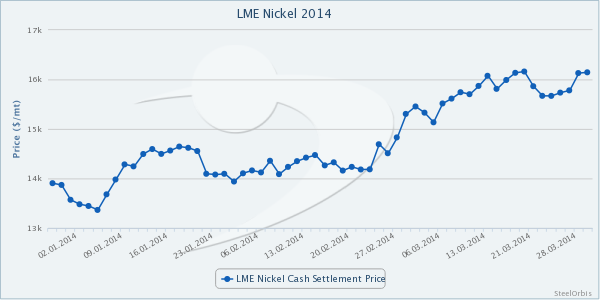

Although nickel prices had indicated slight declines towards the end of last week, prices rebounded early this week and reached the level of $16,145/mt for cash settlements on April 3 at the London Metal Exchange (LME). With the ban of nickel exports from Indonesia, expectations for further increases in nickel prices in the long term have grown and no one foresees a decline in prices in the short term. Amid the support from increased nickel prices, global stainless steel quotations have continued to move upward.

Early this week, Taiwan-based YUSCO announced its new price levels, increasing its local prices by $100/mt and hiking its 304/2B stainless steel cold rolled coil (CRC) export offers by $30-100/mt month on month. In the meantime, stainless steel producers in India and Japan have also announced price increases this month, while stainless steel prices in China have continued to trend sideways amid weak demand.

On the other hand, offers to Turkey for prime quality ready stock 304/2B stainless steel CRC of 2.0 mm thickness from China and Taiwan via stockists and traders have indicated an increase of $100/mt in the past two weeks to $2,500-2,550/mt CIF Istanbul. Meanwhile, offers for similar materials to be produced after receipt of orders from customers are hovering slightly above this range. The short-term trend of stainless steel prices, which have been moving in line with the increase in nickel prices, will likely be determined by demand levels.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.