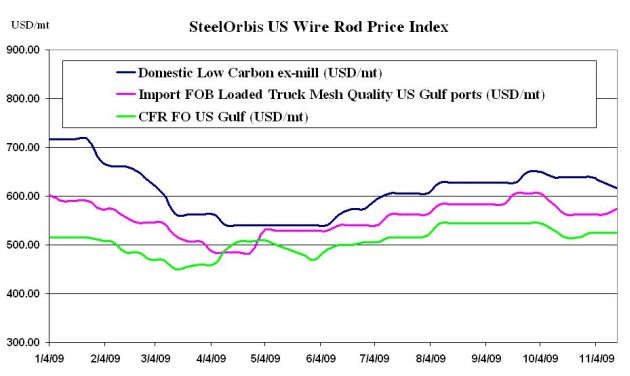

US domestic and import wire rod prices are now drifting in opposite directions as domestic offers continue to sink and offshore offers start to firm up.

Domestic low carbon wire rod offers in the US have dropped by another $0.50 cwt. ($11/mt or $10/nt) within the past week, with most offers now ranging from $27.50 cwt. to $28.50 cwt. ($606/mt to $628/mt or $550/nt to $570/nt) ex-mill. Domestic offering prices are expected to continue trending down in the near-term, though the outlook for US wire rod remains better than that for rebar.

Although US rod prices are still trending down, the price gap between rod and rebar continues to widen. US rod mills, albeit while operating at drastically reduced capacities, have been able to fill their December order books with bookings of cold heading, automotive quality grades, and this has helped mills from getting too desperate in seeking low carbon, mesh-grade orders. There are also some sparks of optimism in the market now that Turkish mills have booked some ex-US scrap in the last couple weeks, spurring speculation that US scrap prices may rise in December.

As for imports, Chinese mills are seeing strength in their home market and have raised their offers for the US accordingly. On the whole, Chinese offers of mesh-grade rod for the US have moved up by about $0.50 cwt. since last week. Currently, both Chinese and Turkish mesh grade offers now range from approximately $25.50 cwt. to $26.50 cwt. ($562/mt to $584/mt or $510/nt to $530/nt) duty-paid, FOB loaded truck in US Gulf ports.

Turkish prices have stayed stable at the abovementioned range since last week, though Turkish mills' price expectations are also starting to improve due to an increase in scrap prices in the region. At the same time, traders say that even at the current prices, import rod offers from China and Turkey are still "unsellable" in the US market as domestic demand remains weak overall and domestic prices remain on a downward slope.

Still, as the below price graph shows, it is never too long before the domestic and import price trends start to sync up again. So, if the sentiment for scrap continues to look positive for December and the import price trend continues to be up as well, this could lead to the bottoming out of the US market and a turn-around in domestic rod prices as soon as January of February of next year.