Despite a number of challenges such as the ongoing pandemic, economic and financial difficulties, sky-high freight rates and increased costs, Turkish longs producers definitely saw some strengthening of their positions in 2021 as compared to the previous year. The relative recovery of steel consumption in certain regions of the world and the gradual reopening of the markets, in line with vaccinations, supported healthier pricing for long steel in 2021 versus the drastic drops seen in 2020. As a result, Turkish mills not only managed to increase longs production, supported by higher local and export consumption, but also the profitability of their sales improved compared to the situation seen in 2020, SteelOrbis has observed.

In particular, in the January-November 2021 period, Turkey’s longs production increased by 16.5 percent year on year to 24.16 million mt, supported by better business activity. In fact, domestic longs consumption rose by 14.2 percent in the same period to 14.34 million mt, the Turkish Steel Producers’ Association (TCUD) data show. The situation on the export side also improved in 2021, although Turkish mills were certainly struggling to maintain regular sales. As regards rebar alone, exports in the first 11 months last year totaled 6.6 million mt, with Israel taking a 47 percent share, followed by Yemen with 13 percent. Asian countries, including Hong Kong and Singapore, accounted for 16 percent, while Peru and Brazil had an eight percent share of Turkey’s rebar exports. Together with wire rod and merchant bar, Turkey’s longs exports in the first 11 months last year increased by over 20 percent year on year and slightly exceeded 11 million mt, according to the TCUD data.

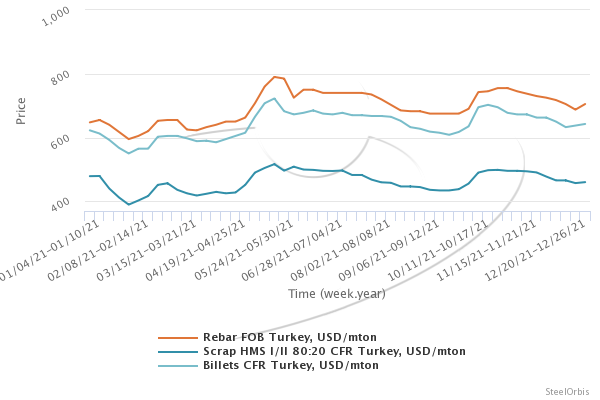

Turning to prices, 2021 showed a significant improvement in rebar price levels across the world and in Turkey in particular. While in 2020 the average export rebar price from Turkey was as low as $450/mt FOB, according to SteelOrbis’ reference price series, in 2021 the average price indication rose to $695/mt FOB, while the highest level reached around $780-790/mt FOB. The relatively healthier situation in the import scrap segment and the fact that the recurring demand from Asia cooled off the pressure on billet pricing somewhat became supportive factors for a better price situation in the rebar segment as well.

The higher pace of price increase for long products seen last year allowed Turkish mills to significantly increase their revenues in 2021, even despite the 1.5-fold rise in their costs of production. According to SteelOrbis’ estimations, given the price increase for scrap, in 2021 the cost of rebar production for EAF-based steelmakers increased by 40 percent to $600-690/mt depending on the mill (on ex-works basis). The wire rod cost of production from imported billet increased by 1.5-fold to $700-760/mt during 2021.

At the same time, import billet usage for rebar production remained non-profitable as compared with utilizing crude steel production capacities. According to SteelOrbis’ estimations, the cost gap between scrap and billet usage in rebar output had almost reached $100/mt by the end of 2021. Only wire rod and merchant bar producers in Turkey saw positive margins from rolling imported billet, and so they remained the main buyers of semis from Russia and Ukraine.

By the end of 2021, the margin per metric ton of Turkish rebar made from EAF-based steel and traded in the domestic market increased to $30-80/mt, versus $10-20/mt seen during the second half of 2020. The profitability of export rebar sales in 2021 improved to $30-60/mt. However, it is worth mentioning that during the first half of 2020 the production of Turkish rebar from scrap in EAFs was barely profitable in sales in both the domestic and export markets. The margins of the mills producing wire rod from imported billet increased to $30-70/mt in 2021, versus $10-40/mt in 2020.

In the first half of last year, the situation in the import scrap segment was the key influencing factor in relation to the cost of production in EAFs. Starting from September, the rise in prices for electricity and gas started to influence production costs. The expected surge of electricity tariffs by 20-25 percent in the fourth quarter was supposed to push up the production costs of EAFs by $15-20/mt, SteelOrbis has estimated. However, the severe devaluation of the Turkish lira against the US dollar seen in the October-December period almost by 50 percent offset the higher electricity costs if calculated on dollar basis. As a result, in the fourth quarter the electricity cost of EAF-based steel production even softened slightly, by four to five percent.

In December, the decline in import scrap prices by 5-10 percent had a key effect on the cost of production in EAFs. Raw material-based costs for EAFs by the end of the month decreased by $40/mt to $500-525/mt. The cost of rebar production from EAF-origin steel shrunk by six percent to $620-670/mt on ex-works basis.

By the end of 2021, Turkey-based longs producers maintained a rather high profitability. According to SteelOrbis’ data, the margins of EAF-produced rebar sales to both local and export customers reached $40-80/mt depending on the producer.

Overall, 2021 can be described as a “more successful” year for the Turkish longs producers as compared to the previous year of the pandemic. The unstable economic situation in Turkey, the sharp devaluation of the national currency and the significant price increase for energy resources were to a certain extent overlapped by a significant global economic recovery. The revival of demand across major consuming regions triggered price increases in all sectors, allowing producers to increase profitability in their segments, even despite the ongoing pandemic and the worsening of the situation in some regions.