US wire rod producers have firmed up prices further since last week as worries about tightening supplies have intensified.

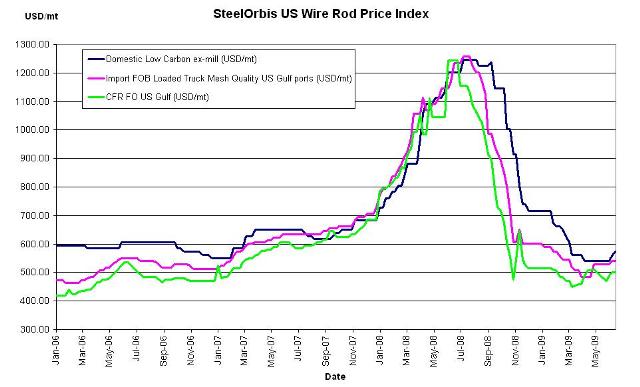

Most US mills are now offering low carbon wire rod in the range of approximately $25.50 cwt. to $26.50 cwt. ($562 /mt to $584 /mt or $510 /nt to $530 /nt) ex-mill, which reflects an increase of about $0.50 cwt. ($11 /mt or $10 /nt) since last week. Furthermore, the pricing trend for domestic wire rod is still pointing upwards, as the imminent closures of two major US wire rod production facilities loom over the market.

The July 12 closure of ArcelorMittal's Georgetown, South Carolina wire rod mill is already taking place in stages, and combined with Gerdau Ameristeel's Perth Amboy, New Jersey rod mill going offline as of August 15, there are increasing concerns about supply. Furthermore, there are next to no imports in the pipeline either. China continues to be absent from the market with its uncompetitive price ideas.

While demand remains lackluster, wire drawers' rod inventories are dwindling and there is more of a willingness to pay the new prices to replenish inventories. Still, there is not enough transactions to justify mainting the Georgetown or Perth Amboy plants' production, and there is unlikely to be enough demand to require a ramp-up in US rod production for some time.

Meanwhile, Turkish mesh-quality wire rod offers for the US are still at a range of $24.00 cwt. to $25.00 cwt. ($529 /mt to $551 /mt or $480 /nt to $500 /nt) duty-paid, FOB loaded truck in US Gulf ports , and there is still no interest among US buyers to book imports at this level, given its proximity to US prices and lengthier lead times. Other regions for Turkish rods are also just lukewarm and for this reason, it is still expected that Turkish mills may adjust their offers slightly in order to generate some US interest.