After many weeks of stability, US wire rod prices have finally started to edge upwards within the last week.

SteelOrbis has confirmed that most US mills are offering and booking low carbon wire rod at a range of $25.00 cwt. to $26.00 cwt. ($551 /mt to $573/mt or $500 /nt to $520 /nt) ex-mill, which is up $1.00 cwt. ($22 /mt or $20 /nt) from last week.

Demand for wire rod is still poor, but supply constraints, including the deep cuts domestic mills have made in their output in addition to the prolonged absence of competitive import offers, are supporting a slightly upward price trend for US wire rod.

In addition to the current supply constraints, scrap costs are trending sideways to slightly up going into the summer months, and further US wire rod production will be taken offline with the imminent closure of Gerdau Ameristeel's Perth Amboy, New Jersey mill and the probable closure of ArcelorMittal's Georgetown, South Carolina plant (scheduled to close July 12, pending corporate-union negotiation outcome).

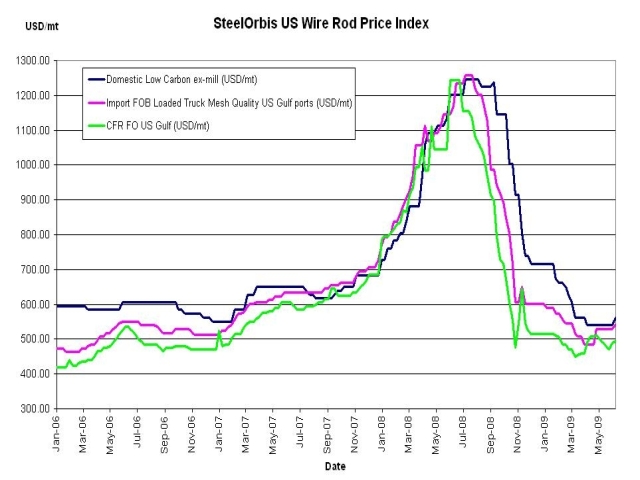

Nevertheless, even with more capacity about to be taken offline and the guarded optimism that has emerged in the US longs markets in the last couple weeks, mills are not full, and the downstream wire market continues to be very slow. Business continues to be severely down from year-ago levels. See the below price chart from SteelOrbis' historical price archive to see just how far US wire rod prices have fallen in the last last year. But on the bright side, the downward price trend now seems to be over. Mills are starting to get orders again as customers are starting to fill holes in their inventories, and these deals are transpiring at the new ($25.00 cwt. to $26.00 cwt.) price range. Also, with the closure of Perth Amboy, Gerdau Ameristeel's other rod plants in Beaumont, Texas and Jacksonville, Florida are expected to see a resulting upturn in orders.

As for imports, based on the latest offers from Turkish mills, most offers for import mesh-grade rod would range from approximately $24.00 cwt. to $25.00 cwt. ($529 /mt to $551 /mt or $480 /nt to $500 /nt) duty-paid, FOB loaded truck in US Gulf ports, which is up $0.50 cwt. ($11 / or $10 /nt) from last week. However, there have been no takers at this price level, as most rod buyers in the US are still able to get a better deal from a domestic mill, and quicker lead times. So far, the Turkish mills have been holding out at the new price levels, but there is a chance that they may lower prices if they don't get any bookings at this range. For now, as the current price range has yet to be accepted by US buyers, the price trend for import wire rod offers from Turkey is neutral.