The price trends of the main steelmaking raw materials - iron ore and coking coal - were watched closely in 2023 since, even though raw material prices declined, they were in general higher than expected, impacting the margins of major steelmakers. Leading players in these markets surveyed by SteelOrbis have described the price expectations for 2024 for the major raw materials as “strong enough”.

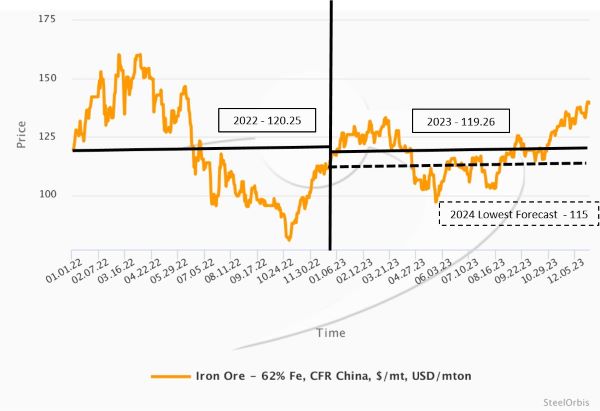

Iron ore prices were at higher-than-expected levels in 2023 amid some small annual increases in crude steel production in China and given the impact of futures prices. The average price of iron ore with 62 percent Fe content in 2023, according to SteelOrbis’ data, was at $119.29/mt CFR (for data up to December 26), just slightly down from the 2022 average of $120.25/mt CFR. Prices were fluctuating in a narrower range than in 2022, but with the same pattern of higher prices early in the year and a downward trend and the lowest prices observed in the May-September period. However, in 2023 the last quarter of the year was much better than usual, with steel production cuts not being so steep and with very low port inventories in the range of 97-108 million mt, versus the usual 120 million mt and higher.

By the end of 2023, prices for import iron ore with 62 percent Fe content touched the $140/mt CFR mark on December 22, reflecting strong market conditions even in the traditionally weak season for demand. Since transportation was negatively affected by extremely cold weather in China in December - the heavy snowfall in northern China, the 6.2-magnitude earthquake in Gansu and the rare icy weather conditions in northern China - import iron ore prices may increase in the near future. Moreover, there may be stock replenishments of iron ore ahead of the Chinese New Year holiday, which would provide strong support for prices in the first quarter of 2024.

According to sources among steelmakers and traders polled by SteelOrbis, iron ore prices may first increase in 2024, though they will likely move down in the latter part of the year, with prices foreseen to fluctuate in the range $95-145/mt during the whole year. “The possible average price [for 2024] is around $115/mt CFR,” one of the major market players said. A few other sources agreed that the average price should be around $115-120/mt CFR next year, not far from the price levels in 2023.

Both supply and demand in the iron ore market are anticipated to improve in 2024, while the rise in supply will be bigger than the increase in demand. The supply of iron ore in the global market is expected to increase by 47.5 million mt, including 32.5 million mt of iron ore from overseas miners and 15 million mt of Chinese domestic production, according to the estimations of market sources. China’s demand for iron ore could increase by 8 million mt, while demand in overseas markets could rise by 24 million mt, and so there would be oversupply in the iron ore market, which would exert a negative impact on prices, though this impact would be limited amid the relatively positive expectations for the Chinese market, which is the main driver of global iron ore prices.

Coking coal prices in the global market were also at lower levels in 2023 compared to 2022, but supply remained the main factor in the market. According to SteelOrbis’ data, the average ex-Australia premium hard coking coal price stood at $295.68/mt FOB in 2023, dropping by $68.92/mt from 2022. Such a sharp drop is explained by the effects of Russia’s war on Ukraine and the high base of prices in 2022 against the backdrop of the EU’s ban on ex-Russia coal imports while, even before Russia’s invasion of Ukraine, supply issues were visible due to adverse weather conditions in Australia and Canada. In general, price expectations for 2023 were lower, at around $250-260/mt FOB, while prices were fluctuating above $300-320/mt FOB in the fourth quarter, which was also assessed as being relatively high.

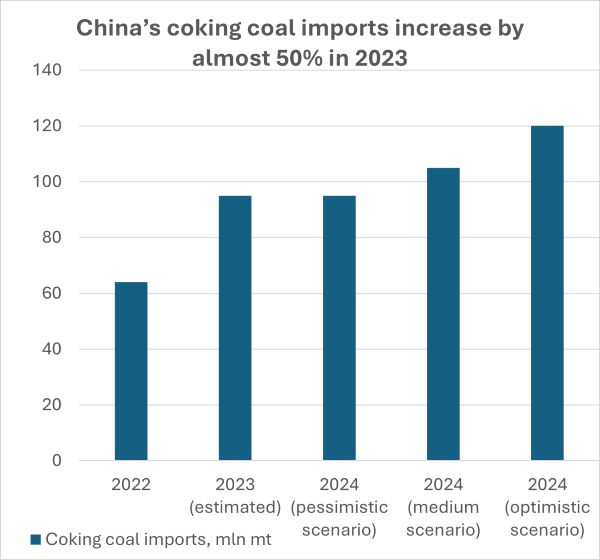

In 2024, China’s coking coal output may remain steady or indicate a slight rise. At the end of 2023, there were several mining accidents in China, which will limit the release of coking coal production in the first half of the year. In 2024, China’s overall coking coal import volume will likely range from 95 million mt (pessimistic forecast), similar to the expected 2023 volume, to 105 million mt (medium-case scenario), to 120 million mt (optimistic scenario), according to a number of sources including miners, steel producers and analysts of futures prices.

Also, China will reinstate a three percent import tariff on metallurgical coal as of January 1, 2024, except for material from Australia and the ASEAN region. Supply of premium grades of coking coal from North America will be affected as Australia may be more competitive and as overall sources of premium grades are limited in the Chinese market.

Russia announced a flexible export tariff for the period from October 1, 2023, to the end of 2024, varying between four percent and seven percent depending on the exchange rate of the ruble. However, as seen in the fourth quarter of 2023, Russian suppliers, especially those of PCI, will remain interested in sales to China, not having many alternative options. In 2024, China’s imports of Russian coking coal may remain at around 26 million mt, or indicate a slight rise to 30 million mt, according to market sources. Moreover, Mongolia will continue to be the main source of coking coal imports for China, with the volume expected to remain at 50 million mt.

In India, demand for coking coal is expected to increase further in 2024, even though at a slightly slower pace than in 2023. India will remain one of the fastest-growing markets for steel, with its steel demand expected to increase by 7-10 percent in the fiscal year 2024-25 (starting in April 2024), as compared to the increase of 11-12 percent in the current fiscal year. Since slightly more than 45 percent of all steelmaking capacities in the country are BOF-based, this increase in demand will be reflected in higher imports of coking coal. However, some greater diversification of purchases (more than half from Australia now) is expected. In particular, Indian mills will be more interested in buying from Russia at lower prices and will gradually increase their dependence on local coking coal, the quality of which has been increasing recently. Coal India reported an increase of 12 percent in domestic production to 35.97 million mt in the April-November period of 2023.

Supply of coking coal will remain constrained in general in 2024, but some gradual rises are forecast in exports from Australia, by as much as 9 million mt, according to Australia’s Department of Industry, Science and Resources. Demand from the two main buyers, China and India, will be stable or may increase gradually, and so coking coal prices in 2024 may again be stronger than initially expected, according to market sources. Major investment banks and analysts are predicting ex-Australia premium hard coking coal prices will fall to levels of $210-230/mt FOB in 2024. However, given the expected strong first quarter with reduced supply in the local market in China, the usual harsh weather conditions in Australia, and the fact that 2023 ended at levels of $320-330/mt FOB, the forecasts may be corrected again in an upward direction.