European steel market has been suffering from unfolding recession and bottlenecks in trade arising due to war during the last two years. Rising inflation and tight monetary policy are also in the list of main factors negatively influencing steel demand. The ECB has raised interest rates by 6 times this year. And though the inflation rates started slowing down, it is still far from the target level of 2 percent.

HRC production margins fell by 15 percent in 2023. Weak demand pressure forced metallurgical companies to give up some of their profits and to cut finished steel prices by 20 percent in annual comparison.

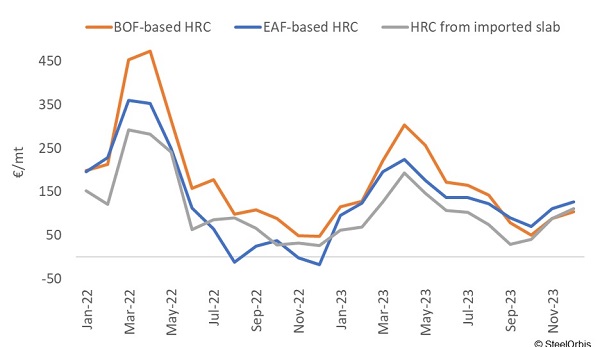

Weak positions of producers are always visible in fluctuating market conditions. European EAF steel producers had become unprofitable in the second half of 2022 due to energy crisis. BOF steel producers are losing ground starting from June 2023. In the fourth quarter of 2023, BOF-based HRC margin was even lower than the one from EAF steel and imported slab.

Margins of European HRC producers in euro, EXW basis

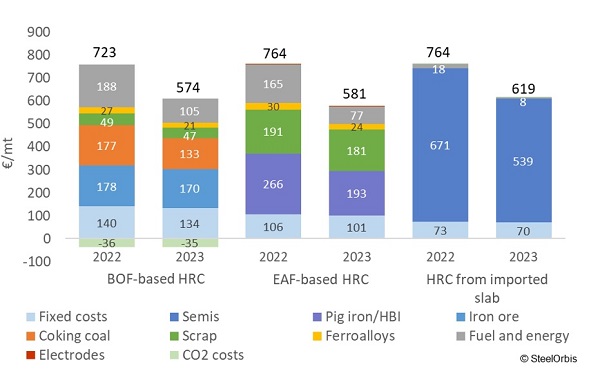

Producers of EAF-based HRC managed to significantly reduce costs by 24 percent in 2023 thanks to the decline in electricity prices. Costs for BOF-based HRC and HRC from imported slab decreased by 21 and 19 percent, consequently. The reduction in iron ore and coking coal costs was insufficient to guarantee the full advantage of BOF steel, while steel scrap and electricity prices actively responded to market sentiment.

Italian HRC full cost structure, EXW basis

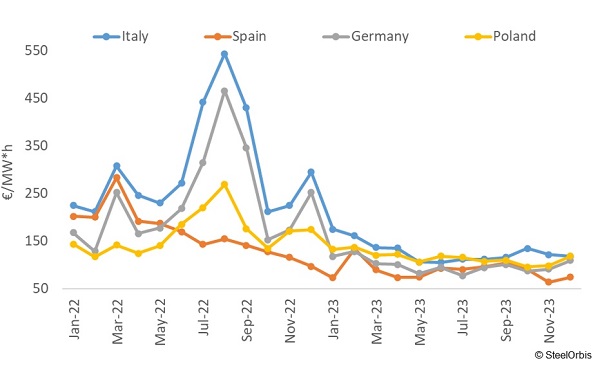

Government subsidies to the energy industry, increase in renewable energy production and diversification of gas suppliers made it possible to overcome the warm phase of the energy crisis in Europe, however, its consequences are still noticeable. In 2023, natural gas prices fell by 60-70 percent in annual comparison. Electricity prices in the key HRC producing countries went down by 30-58 percent. Thus, EAF-based HRC producers, who were unprofitable in the second half of 2022, made more profit than BOF-based HRC suppliers from September to December of 2023. However, EAF steel producers do not expect significant declines in electricity prices in 2024. Prices will not reach pre-pandemic levels due to inflation. The movement of prices has already begun to slow down within the range of €80-120/MWh.

The electricity price in the European countries that supply flat products

Slow rate of iron ore and coking coal price reduction had the biggest impact on European BOF steel producers’ lower competitiveness in 2023. Asian countries are the largest producers of BOF steel, as well as the largest consumers of iron ore and coal. On one hand, Chinese government has its own instruments of prices and demand regulation. On the other hand, India’s steel market is expected to continue its growth on the back of government investments in infrastructure. Growth in developing countries goes counter to the premium but slowing European market.

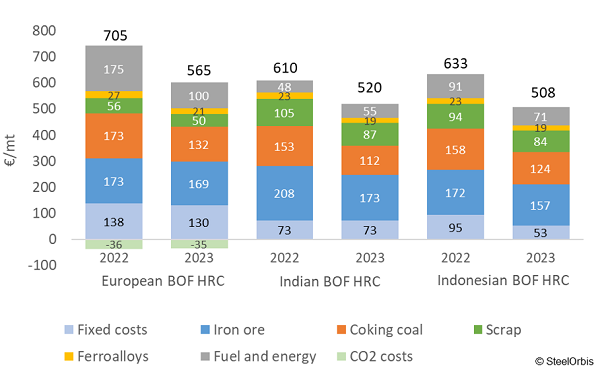

BOF-based HRC full costs structure, EXW basis

Russia remained as the main slab supplier to Europe in 2023, accounting for 55-80 percent of total imports in certain months of 2023. Subsidiaries of Russian metallurgical companies lobbied for the extension of import quotas for Russian slabs for another four years with steady reduction of quota volumes until 2028. This decision could negatively affect some market participants since Russian slabs are sold with discounts. In 2022, the discount rate for slabs from Russia into Europe were evaluated at the level of 10-20 percent. Nevertheless, in contrast to slabs, HRC import segment was dominated by Asian suppliers, lead by Indian and Indonesian sellers in particular.

BOF-based HRC costs of European and Asian producers was as close to each other as possible in 2023, meaning that Indian and Indonesian companies’ margin corresponded with the European producers’ range. Low cost of fuel and energy have always been the key advantage of Asian steel producers, and the high scrap prices have always been the notable weakness. In 2023, scrap quotations were at least 10 percent higher in Asian countries than in Europe. However, scrap prices will rise influenced by the decarbonization movement in Europe.

European BOF steel producers will be able to escape a trap of low finished steel prices and loss of competitive cost level only with demand recovery in the European market. Scrap prices in Europe will increase in long-term perspective. Fuel and energy costs of European producers are preventing them to reach the level of Asian competitors. Quotations of iron ore and coking coal will be affected by developing Asian countries in the next few years.