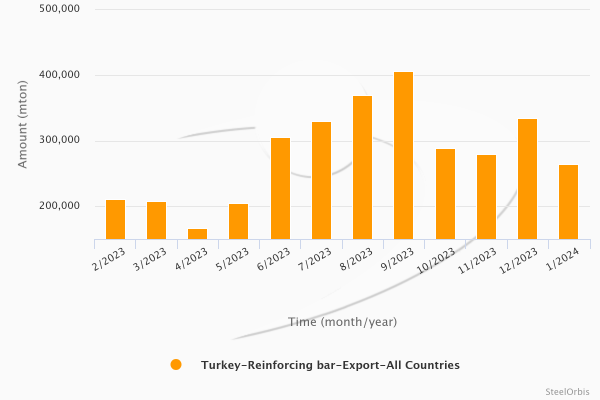

In January this year, Turkey’s rebar exports amounted to 265,504 metric tons, down by 20.8 percent compared to December and by 13.8 percent year on year, according to the preliminary data provided by the Turkish Statistical Institute (TUIK). Meanwhile, the revenue generated by these exports totaled $155.05 million, declining by 21.9 percent compared to the previous month and by 23.2 percent year on year.

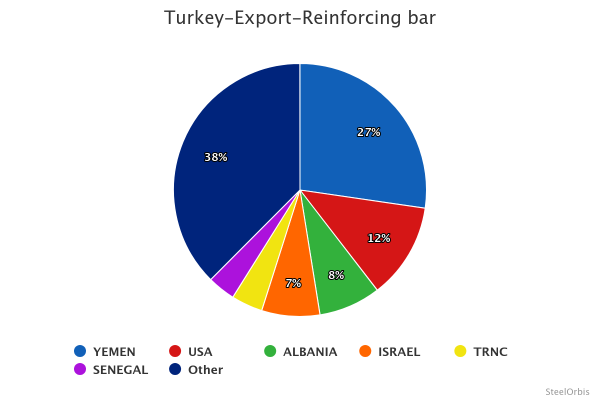

In the given month, Turkey’s largest rebar export destination was Yemen which received 72,497 mt, down 9.6 percent year on year. Yemen was followed by US with 32,501 mt, down 1.0 percent, and Albania with 21,051 mt, up 320.4 percent, both on year-on-year basis.

Turkey’s top 10 rebar export destinations in January this year:

|

Country |

Amount (mt) |

|

|

|

|

January 2024 |

January 2023 |

Y-o-y change (%) |

|

Yemen |

72,497 |

80,210 |

-9.6 |

|

US |

32,501 |

32,839 |

-1 |

|

Albania |

21,051 |

5,007 |

+320.4 |

|

Israel |

19,736 |

67,141 |

-70.6 |

|

Northern Cyprus |

10,618 |

8,461 |

+25.5 |

|

Senegal |

9,467 |

310 |

+2953.9 |

|

Bosnia and Herzegovina |

8,599 |

- |

- |

|

United Kingdom |

7,500 |

- |

- |

|

Trinidad and Tobago |

6,932 |

4,442 |

+56.1 |

|

Romania |

6,628 |

4,999 |

+32.6 |

Turkey’s main rebar export destinations on country basis in January this year are presented below: