The Brazilian Ministry of Industry has reportedly opened an antidumping investigation into a variety of products imported from China, with a particular focus on steel. Brazilian steel producers are seeking 10-25% tariffs to be levied on Chinese steel imports, which have risen about 50% from 2022 to 2023 (Brazil imported about 5.02 million tonnes in 2023 versus 3.35 million tonnes in 2022). Given Brazil’s heavy reliance on China for its iron ore exports, this situation will no doubt be a challenge to navigate for Brazilian authorities.

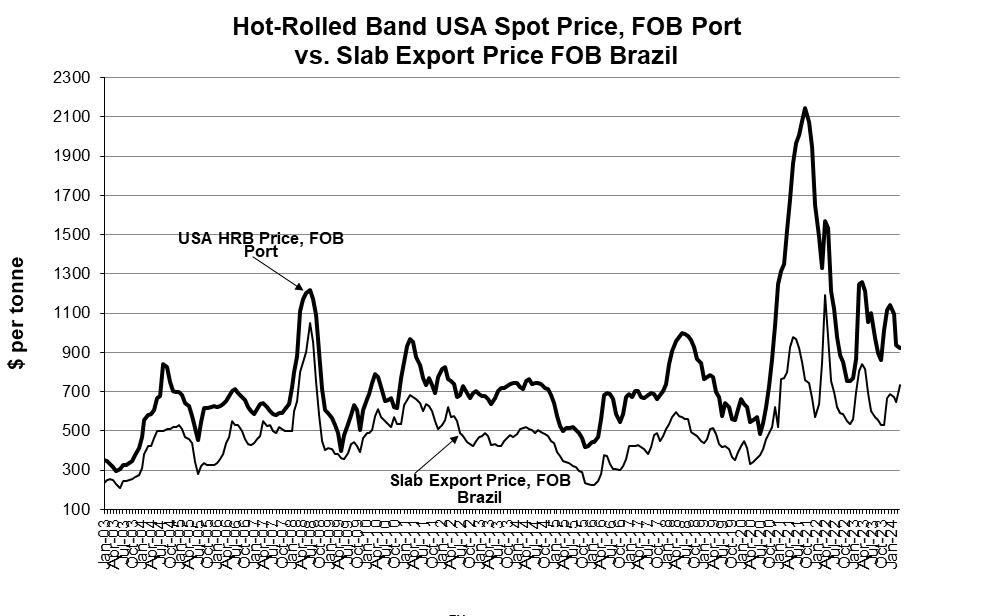

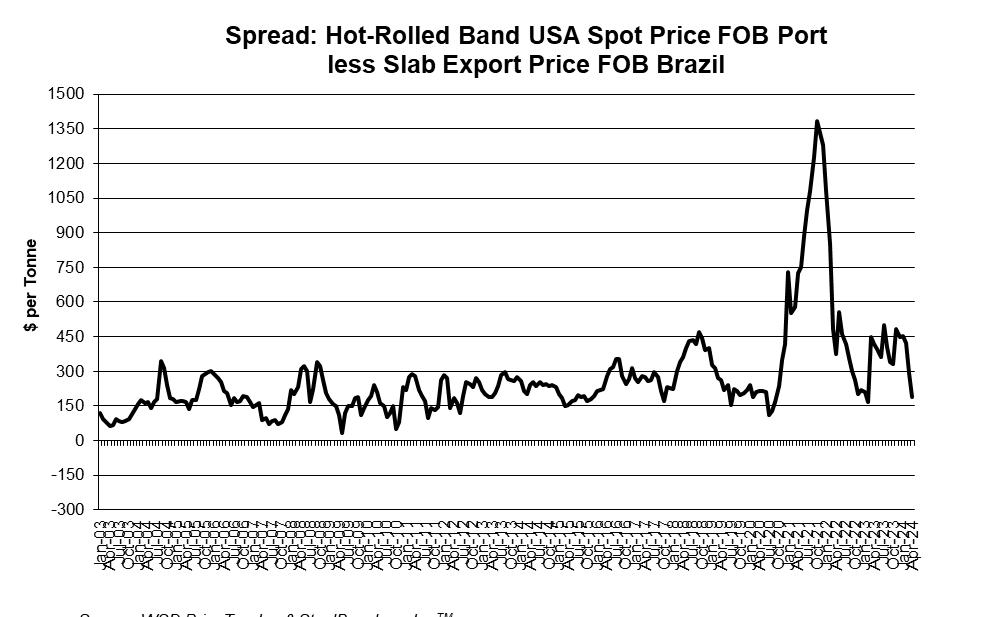

Slab prices FOB Brazil, recently reported at about $732 per tonne, could be headed lower in the opinion of one WSD contact, especially considering the recent HRC price dynamics in the USA and the shrinking HRC-slab spread. Brazilian slab exporting mills could be facing stiffer competition with competing offers from Indonesia reportedly priced $100 per tonne below Brazilian offerings.

• The USA HRB price and the Brazilian slab price, FOB the port of export. As indicated, the spread has often in the past been less than $300 per tonne range – dropping occasionally to about $32 per tonne at its lowest and had risen to a peak of about $1,380 in October 2021 but has dropped back to about $188 per tonne.

Lately, Brazilian slab exporters to the USA are probably obtaining a $100+ per tonne higher price than is the case for slab exports from other origins, such as Indonesia, because there’s a quota of 3.5 million tonnes per year on which the 25% duty is not paid. Slab suppliers from Russia, including NLMK that still owns an independent hot strip million in the United States, have to date not been able to avoid paying the USA’s 25% import duty.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2024 by World Steel Dynamics Inc. all rights reserved