A number of import prices are well below US domestic plate spot prices, putting downward pricing pressure on an already-weakening US market.

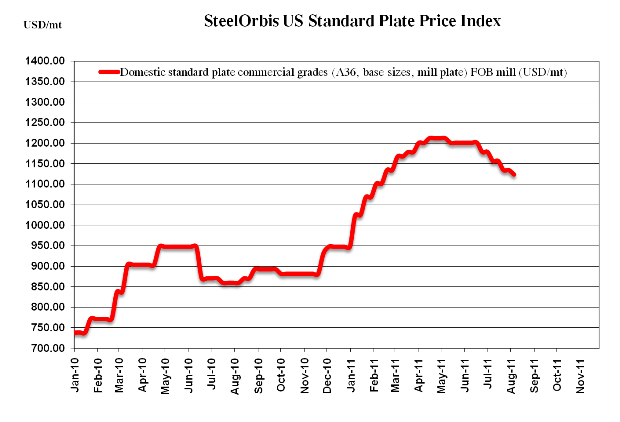

The US domestic plate market has remained quiet over the last few weeks due largely to a summer slowdown in activity. Domestic mill order entry rates are significantly lower than they were just one or two months back as service center inventories are balanced, with many buyers reporting heavy inventories. Additionally, most buyers still believe there is room for plate spot prices to fall from their current level of $50.00-$52.00 cwt. ($1,102-$1,146/mt or $1,000-$1,040/nt) ex-Midwest mill--down $1.00 cwt. ($22/mt or $20/nt) on the low end in the last two weeks--and are therefore abstaining from placing orders right now.

In addition to lower activity, US plate spot prices are under pressure to fall from import prices that are as much as $7.00 cwt. ($154/mt or $140/nt) lower than US prices. The most competitive offers are coming from Russia, still in the range of $43.00-$44.00 cwt. ($948-$970/mt or $860-$880/nt) DDP loaded truck in US Gulf ports--unchanged from late July; even with mostly November arrival dates, several orders have been booked.

While Russian plate is currently the most appealing to US buyers, a number of other offshore sources are also offering plate to the US. Like Russian prices, Turkish and Brazilian plate prices for the US have remained neutral in the last two weeks and are still $45.00-$46.00 cwt. ($992-$1,014/mt or $900-$920/nt) and $46.00-$47.00 cwt. ($1,014-$1,036/mt or $920-$940/nt), respectively, both DDP loaded truck in US Gulf ports. Plate from Taiwan and Thailand has also been offered to the US, and most prices are in the lower range of $43.00-$44.00 cwt. DDP loaded truck in US Gulf ports.